Utility Billing Software Market Size, Share and Industry Analysis, Report 2024-2032

Utility Billing Software Industry

Summary:

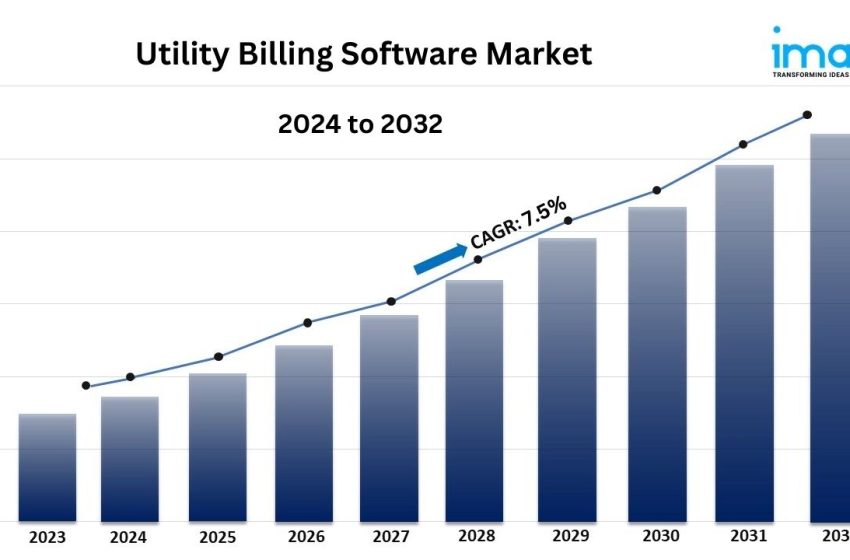

● The global utility billing software market size reached USD 5.5 Billion in 2023.

● The market is expected to reach USD 10.6 Billion by 2032, exhibiting a growth rate (CAGR) of 7.5% during 2024-2032.

● North America leads the market, accounting for the largest utility billing software market share.

● Cloud-based accounts for the majority of the market share in the deployment mode segment due to its scalability and cost-efficiency.

● Based on the type, the market has been segmented into platform as a service, infrastructure as a service, and software as a service.

● Power distribution holds the largest share in the utility billing software industry.

● The increasing requirement for effective utility management systems is a primary driver of the utility billing software market.

● Significant developments in smart metering systems and the integration of IoT technologies are reshaping the utility billing software market.

Industry Trends and Drivers:

● Rising demand for efficient utility management solutions:

The utility billing software market is primarily driven by the rising need for utilities, such as electricity, water, and gas, to manage their operations more efficiently. As utility providers face increasing pressure to deliver seamless services to a growing customer base, manual billing processes are becoming outdated. Utility billing software automates various billing tasks, improving accuracy and reducing human errors in billing cycles. This software also helps utility companies handle large volumes of customer data and multiple billing formats, making it easier to track usage, generate invoices, and ensure timely payments. As the utility sector expands, the demand for more advanced and efficient billing solutions is increasing, propelling the growth of the utility billing software market.

● Advancements in smart metering and IoT integration:

The integration of smart metering technologies and the Internet of Things (IoT) in utility management is significantly influencing the utility billing software market. Smart meters allow for real-time data collection on utility usage, providing more accurate billing and enabling dynamic pricing models based on consumption patterns. Utility billing software can process this real-time data, offering customers detailed insights into their usage and helping them make informed decisions about resource consumption. Moreover, the IoT-enabled smart metering system helps utilities monitor and detect issues such as leaks or energy wastage, leading to more efficient service delivery. The adoption of these technologies is increasing globally as utility companies seek to modernize their infrastructure and provide better customer experiences, increasing demand for utility billing software that can handle these advanced systems.

● Growing focus on regulatory compliance and reporting:

The utility sector is subject to a complex web of regulations that require accurate tracking and reporting of customer data, usage, and billing information. Utility billing software is essential for helping providers comply with these regulations by automating the documentation and reporting process. With increasing scrutiny on environmental standards and energy efficiency, utility companies are being required to provide transparent reporting on consumption, emissions, and sustainability efforts. Utility billing software solutions help companies manage regulatory compliance, ensuring accurate record-keeping and timely reporting to regulatory bodies. The rising emphasis on transparency and accountability in the utility sector is driving the adoption of software that streamlines these compliance processes, further facilitating industry expansion.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/utility-billing-software-market/requestsample

Utility Billing Software Market Report Segmentation:

Breakup By Deployment Mode:

● On-premises

● Cloud-based

Cloud-based accounts for the majority of shares as it considerably reduces the burden of infrastructure management, reducing capital expenditures and operational overhead.

Breakup By Type:

● Platform as a Service

● Infrastructure as a Service

● Software as a Service

Based on the type, the market has been segregated into platform as a service, infrastructure as a service, and software as a service.

Breakup By End User:

● Water

● Power Distribution

● Oil and Gas

● Telecommunication

● Others

Power distribution represents the majority of shares due to the high complexity and scale of managing electricity consumption, billing, and payments for a vast number of residential and commercial customers.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America holds the leading position owing to a large market for utility billing software driven by its advanced utility infrastructure and the widespread adoption of smart technologies, such as smart meters and IoT solutions.

Top Utility Billing Software Market Leaders:

● Continental Utility Solutions Inc.,

● ePsolutions Inc.

● Exceleron Software

● Harris Computer (Constellation Software Inc.)

● Jayhawk Software Inc.

● Jendev Corporation

● Methodia Group

● Oracle Corporation

● Sigma Software Solutions Inc.

● SkyBill SIA

● Utilibill Pvt. Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.