Understanding Year-to-Date (YTD): Meaning, Importance, and Calculation

In the world of finance and accounting, the term “Year-to-Date” (YTD) is a critical concept used across various financial documents and reporting systems. Whether you’re analyzing financial statements, preparing tax documents, or managing a company’s budget, understanding YTD metrics is essential for making informed decisions. This article will delve into the meaning of YTD, its importance in financial planning and reporting, and how to calculate it. Additionally, we’ll touch upon tools like a paystub generator free, which can help in calculating YTD figures efficiently.

What is Year-to-Date (YTD)?

Year-to-Date (YTD) refers to the period beginning at the start of the current calendar year (or fiscal year) up until the present date. It’s a financial term used to describe the cumulative total of various financial metrics from the beginning of the year to the current date. YTD figures are crucial for understanding how performance metrics and financial indicators have evolved over time and how they stand in relation to budgetary targets or historical performance.

For instance:

- In the context of payroll, YTD earnings include all income an employee has earned from January 1st up until the current date within that year.

- For investment portfolios, YTD returns measure the total return of an investment from January 1st to the present day.

Importance of Year-to-Date (YTD) Figures

-

Performance Measurement: YTD figures provide an up-to-date snapshot of performance. For businesses, tracking YTD revenue, expenses, and profits helps gauge how well the company is performing against its goals. Investors use YTD returns to assess the performance of their investments and make informed decisions based on current trends.

-

Financial Planning and Forecasting: YTD data helps in budgeting and forecasting. By analyzing YTD performance, businesses can adjust their forecasts and budgets for the remainder of the year. This data is crucial for making adjustments in operational strategies and financial planning.

-

Tax Preparation: YTD figures are instrumental in preparing for taxes. Employees and employers alike use YTD earnings to determine income tax liabilities. For individuals, knowing YTD earnings helps in estimating tax payments and deductions. Businesses need YTD figures to accurately calculate income tax liabilities and report to tax authorities.

-

Comparative Analysis: YTD metrics allow for comparative analysis with previous years’ performance or industry benchmarks. This helps in evaluating whether a company or investment is improving, stagnating, or declining relative to past performance or industry standards.

-

Financial Statements and Reporting: YTD figures are included in financial statements to provide a comprehensive view of a company’s financial health. For instance, income statements, balance sheets, and cash flow statements often incorporate YTD figures to give a detailed picture of financial performance up to the current date.

How to Calculate Year-to-Date (YTD)

Calculating YTD figures involves aggregating data from the start of the year up to the present date. Here’s a general guide on how to calculate YTD for different financial metrics:

1. YTD Earnings: To calculate YTD earnings, sum all the earnings or income an individual or employee has received from the beginning of the year until the current date. This includes regular salary, bonuses, overtime pay, and other forms of compensation.

Formula:

YTD Earnings=Sum of all earnings from January 1 to current datetext{YTD Earnings} = text{Sum of all earnings from January 1 to current date}

Example: If an employee earns $3,000 per month and receives a $500 bonus in June, by the end of August, their YTD earnings would be:

YTD Earnings=(3,000×8)+500=24,500text{YTD Earnings} = (3,000 times 8) + 500 = 24,500

2. YTD Revenue: For businesses, YTD revenue is calculated by summing all revenue generated from the start of the fiscal year up to the current date.

Formula:

YTD Revenue=Sum of all revenues from the start of the fiscal year to current datetext{YTD Revenue} = text{Sum of all revenues from the start of the fiscal year to current date}

3. YTD Expenses: Calculate YTD expenses by aggregating all expenses incurred from the beginning of the year to the present date.

Formula:

YTD Expenses=Sum of all expenses from January 1 to current datetext{YTD Expenses} = text{Sum of all expenses from January 1 to current date}

4. YTD Return on Investment (ROI): To determine YTD ROI, calculate the total return of an investment from January 1 to the current date and divide it by the initial investment amount.

Formula:

YTD ROI=(Current Value of Investment−Initial InvestmentInitial Investment)×100text{YTD ROI} = left(frac{text{Current Value of Investment} – text{Initial Investment}}{text{Initial Investment}}right) times 100

Example: If an investment was worth $10,000 at the beginning of the year and is now worth $12,500, the YTD ROI is:

YTD ROI=(12,500−10,00010,000)×100=25%text{YTD ROI} = left(frac{12,500 – 10,000}{10,000}right) times 100 = 25%

Tools for Managing YTD Calculations

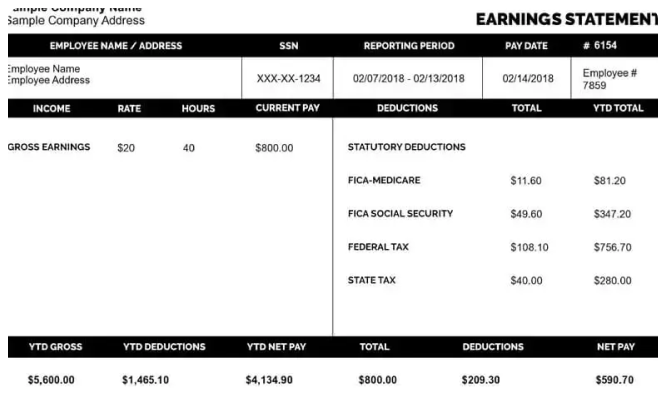

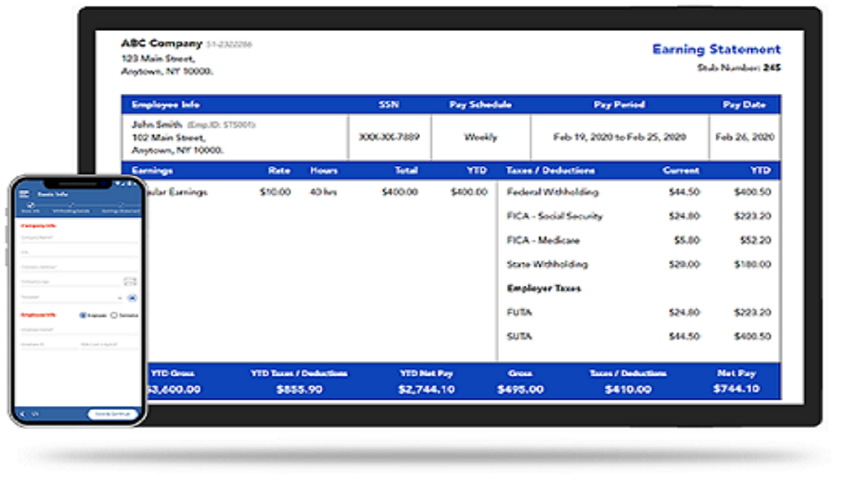

Managing YTD calculations can be streamlined using various tools and software. For instance, a paystub generator free is a useful tool for employees and employers to track YTD earnings accurately. These generators automatically calculate YTD totals for earnings, taxes withheld, and other deductions based on the pay periods entered. This simplifies the process and reduces the chances of manual errors.

Benefits of Using a Paystub Generator Free:

-

Accuracy: Automated calculations minimize the risk of errors in YTD figures, ensuring that the data is accurate and reliable.

-

Convenience: A paystub generator free offers convenience by providing a straightforward way to generate detailed pay stubs and track YTD earnings without needing extensive accounting knowledge.

-

Time-Saving: Using such tools saves time compared to manually calculating YTD figures, allowing for quicker and more efficient financial management.

-

Comprehensive Reporting: Many paystub generators offer detailed reporting features, including YTD summaries and breakdowns of various deductions and earnings, which are valuable for financial planning and reporting.

Conclusion

Year-to-Date (YTD) is a vital concept in financial management, offering insights into cumulative performance from the beginning of the year up to the present date. Understanding YTD metrics is crucial for effective financial planning, performance measurement, tax preparation, and comparative analysis. By calculating YTD figures accurately, businesses and individuals can make informed decisions and manage their financial activities more efficiently.

Utilizing tools like a paystub generator free can further enhance the accuracy and convenience of tracking YTD earnings and other financial data. As we progress through the year, keeping a close eye on YTD figures ensures that you stay on top of your financial goals and adapt to any changes in performance or strategy.