Paystub Creators: The Key to Reducing Payroll Errors

- Business

eformscreator

eformscreator- December 16, 2024

- 2

Payroll processing is one of the most critical yet complex aspects of managing a business. From calculating wages to ensuring tax compliance, the payroll process involves a lot of moving parts. Small businesses, in particular, often face challenges in getting it right, and one of the most common issues that arise is payroll errors. These errors can range from miscalculating paychecks to incorrect tax withholdings, and they can lead to costly fines, disgruntled employees, and a loss of trust.

A paystub creator can help businesses avoid these issues by automating the generation of pay stubs, reducing the chances of errors, and ensuring compliance with tax laws. In this blog, we’ll discuss how a paystub creator can significantly reduce payroll errors, the features you should look for, and why every business—whether small or large—can benefit from using one.

What is a Paystub Creator?

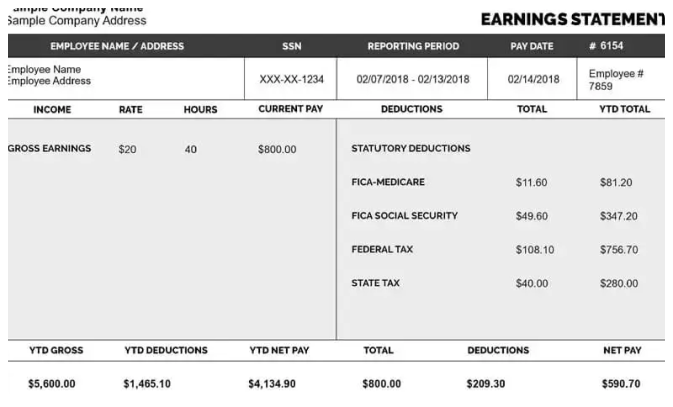

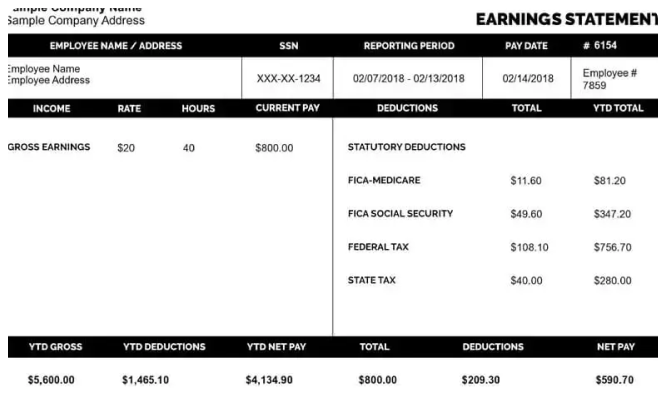

A paystub creator is a digital tool or software that allows employers to generate pay stubs for their employees quickly and accurately. A paystub contains all the details related to an employee’s earnings for a specific pay period, including gross pay, deductions, taxes, and net pay. By using a paystub creator, businesses can automate the process of creating these documents and ensure that they contain accurate and up-to-date information.

While some businesses may still rely on manual calculations or accounting software to generate pay stubs, paystub creators offer a more efficient, streamlined, and error-free way of managing payroll.

The Common Payroll Errors Paystub Creators Help Prevent

-

Incorrect Pay Calculations

One of the most common payroll errors is miscalculating an employee’s pay. This could be due to a simple human error, such as entering the wrong number of hours worked, or it could be a more complex issue, such as incorrect overtime calculations. Paystub creators automate this process, pulling data from time-tracking systems or payroll software to calculate earnings accurately. -

Incorrect Tax Withholding

Tax rates change frequently at the federal, state, and local levels. If these changes aren’t tracked accurately, employers may end up withholding the wrong amount of tax from their employees’ paychecks. A paystub creator can help by staying up-to-date with the latest tax rates and ensuring that the correct amounts are withheld, avoiding penalties from tax authorities. -

Omitting Deductions

Employees may have a variety of deductions taken out of their pay, such as retirement contributions, insurance premiums, or garnishments. Missing a deduction or applying the wrong deduction can lead to an employee receiving an incorrect paycheck. Paystub creators make it easy to track and apply all the necessary deductions to ensure employees get paid correctly. -

Manual Calculation Mistakes

When payroll is done manually, there’s always the risk of human error, whether it’s due to fatigue, distraction, or a lack of knowledge. A paystub creator automates the process and significantly reduces the chances of mistakes, ensuring that employees receive the correct pay every time. -

Payroll Delays

Manual payroll processes can lead to delays, especially if calculations are incorrect or if there’s confusion about the figures. Paystub creators speed up the process by automating calculations and generating pay stubs almost instantly, making sure that employees get paid on time without delays.

Benefits of Using a Paystub Creator

-

Accuracy

By eliminating manual calculations, a paystub creator helps ensure that the pay stubs are accurate. This reduces the chance of errors and ensures that employees are paid the correct amount every time. Automated calculations also take into account any special circumstances, such as overtime, bonuses, or commissions, which can often cause errors if done manually. -

Time-Saving

Payroll processing can be a time-consuming task, especially for small business owners who have to juggle multiple responsibilities. A paystub creator saves valuable time by automating the process, freeing up business owners to focus on other important aspects of running their business. -

Employee Satisfaction

Employees rely on their pay stubs for a variety of reasons, such as verifying their earnings, applying for loans, or filing taxes. When pay stubs are accurate and easy to understand, employees feel more confident and satisfied with their employer. Consistent accuracy in pay also helps build trust between employees and employers. -

Tax Compliance

The tax landscape is constantly changing, and staying on top of federal, state, and local tax regulations can be challenging. A paystub creator is typically designed to stay updated with the latest tax rates, deductions, and exemptions. This ensures that the correct amount of tax is withheld from each employee’s paycheck, reducing the risk of audits, fines, and penalties. -

Record Keeping and Transparency

Keeping accurate records of employee pay is not only important for business operations but also required by law. Paystub creators make it easy to store pay stubs electronically, creating a clear and organized record of payments for each employee. This helps businesses stay compliant with labor laws and also provides employees with easy access to their pay information. -

Cost-Efficiency

While paystub creator tools may come with a subscription fee, they can save money in the long run by reducing costly payroll mistakes. Mistakes like miscalculating wages or tax withholding could lead to fines, penalties, or even legal action, which could be far more expensive than the cost of using a paystub creator.

Features to Look for in a Paystub Creator

When choosing a paystub creator for your business, it’s important to select one that meets your specific needs. Here are some key features to consider:

-

Ease of Use

A good paystub creator should be user-friendly, even for people with little or no payroll experience. The interface should be intuitive, and the tool should guide you through the process of generating pay stubs with ease. -

Customization Options

Every business has its own set of payroll needs. Look for a paystub creator that allows you to customize pay stubs to reflect your company’s specific deductions, bonuses, overtime, and other payroll details. -

Direct Deposit Integration

Some paystub creators integrate directly with payroll systems or bank accounts, allowing for seamless direct deposit payments. This eliminates the need for paper checks and makes it easier to pay employees on time. -

Tax Compliance Tools

Since tax laws and rates change frequently, ensure the paystub creator is regularly updated with the latest tax rates. It should also help you calculate other important elements, such as social security contributions, unemployment insurance, and workers’ compensation. -

Mobile Access

With more employees working remotely or on the go, having mobile access to paystubs is increasingly important. Many paystub creators offer mobile apps or online portals, allowing employees to access their pay stubs anytime, anywhere. -

Security Features

Pay stubs contain sensitive personal information, so your paystub creator must offer strong security features. Look for features such as data encryption and secure login protocols to protect both employee and employer information.

How Paystub Creators Benefit Small Businesses

Small businesses are often tight on resources, making it challenging to manage payroll manually or hire a dedicated payroll specialist. Using a paystub creator can level the playing field, allowing small business owners to process payroll with accuracy and efficiency, without spending hours on calculations.

Here are some specific ways paystub creators benefit small businesses:

-

Affordability

Many paystub creators are affordable and offer scalable pricing plans, making them a practical solution for small businesses on a budget. Some platforms even offer free versions for businesses with just a few employees. -

Reducing Errors

Small businesses often have limited staff, and payroll errors can have a big impact. A paystub creator minimizes human errors, ensuring that payroll is processed without mistakes. -

Staying Compliant

Small businesses may not have an in-house HR or legal team to monitor tax changes and payroll laws. Paystub creators can automatically update to reflect any changes, ensuring that the business remains compliant with federal and state laws. -

Employee Trust and Retention

Employees appreciate knowing they will be paid accurately and on time. By using a paystub creator, small businesses can improve employee satisfaction and reduce turnover, ultimately creating a more positive workplace culture.

Conclusion

Managing payroll can be a daunting task, especially when dealing with numerous employees, multiple deductions, and changing tax rates. However, by using a pay stub creator, businesses can significantly reduce payroll errors, save time, stay compliant, and improve employee satisfaction. Whether you’re a small business owner or manage a larger workforce, investing in a free paystub creator is a smart way to ensure that your payroll process is accurate, efficient, and secure.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season