Managing Payroll in Construction Using Check Stubs

- Business

eformscreator

eformscreator- October 10, 2024

- 13

Managing payroll in the construction industry is a crucial aspect of business operations. Whether you’re a contractor, subcontractor, or construction company owner, ensuring accurate and timely payment to employees is essential for maintaining productivity and compliance with labour laws. One effective tool for streamlining this process is using check stubs. In this blog post, we’ll explore how check stubs can simplify your payroll management, ensure transparency, and help you stay organized.

What are Check Stubs?

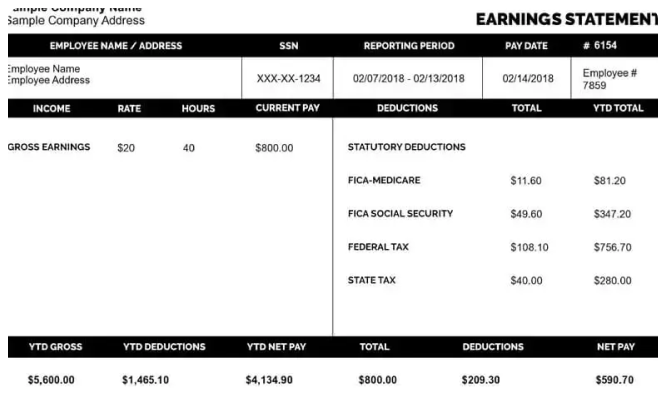

Check stubs, also known as pay stubs or paycheck stubs, are documents provided to employees along with their paychecks. They detail important information about their earnings, deductions, taxes, and other relevant financial information. Check stubs serve as a record of payment and are essential for both employees and employers to keep track of earnings and deductions accurately.

Importance of Check Stubs in Construction Payroll

In the construction industry, where labour costs are a significant portion of expenses, maintaining accurate payroll records is crucial for several reasons:

-

Transparency and Compliance: Check stubs provide transparency to employees regarding their wages and deductions, ensuring compliance with state and federal labor laws.

-

Documentation for Tax Purposes: Both employees and employers need accurate payroll records for tax filing purposes. Check stubs provide detailed information that simplifies tax preparation and compliance.

-

Dispute Resolution: In case of payment disputes or discrepancies, check stubs serve as crucial evidence to resolve issues quickly and fairly.

-

Employee Satisfaction: Providing clear and detailed check stubs enhances employee satisfaction and trust in the payroll process.

Key Elements of Check Stubs

A typical check stub includes various elements that are important for understanding an employee’s compensation and deductions:

-

Employee Information: Name, address, and sometimes social security number.

-

Earnings: Gross wages earned during the pay period, including hourly rates, overtime pay, bonuses, or other compensation.

-

Deductions: Taxes (federal, state, and local), social security contributions, Medicare, health insurance premiums, retirement contributions, and any other deductions.

-

Net Pay: The amount the employee receives after all deductions have been subtracted from gross earnings.

-

Year-to-Date (YTD) Totals: Cumulative totals of earnings and deductions from the beginning of the calendar year to the current pay period.

Using Check Stubs for Payroll Management

Now, let’s delve into how check stubs can be effectively used in managing payroll within the construction industry:

1. Automation and Efficiency

With advancements in technology, many construction companies use automated payroll systems that generate digital check stubs. These systems streamline the payroll process by automatically calculating wages, deductions, and taxes based on the hours worked and employee information entered into the system. This automation reduces the likelihood of errors and saves time for payroll administrators.

2. Compliance with Labor Laws

The construction industry is subject to various labor laws and regulations, including those related to minimum wage, overtime pay, and payroll record-keeping. Check stubs play a vital role in ensuring compliance with these laws by providing clear documentation of wages paid, hours worked, and deductions made. This documentation can be critical during audits by regulatory agencies or in case of legal disputes.

3. Employee Communication and Transparency

Providing employees with detailed check stubs enhances transparency and communication regarding their earnings and deductions. It helps employees understand how their wages are calculated, what deductions are being made, and ensures they receive accurate compensation for their work. Clear communication through check stubs also reduces misunderstandings and improves employee satisfaction.

4. Record Keeping and Accountability

Effective record-keeping is essential in the construction industry for financial management and accountability. Check stubs serve as historical records of payroll transactions, documenting each employee’s earnings and deductions over time. These records are valuable for financial reporting, budgeting, and forecasting purposes, as well as for auditing and compliance verification.

5. Integration with Accounting Systems

Digital check stubs can be easily integrated with accounting software used by construction companies. This integration simplifies financial reporting and ensures that payroll data seamlessly flows into the company’s general ledger and financial statements. It also facilitates the reconciliation of payroll expenses and provides real-time visibility into labor costs.

Tips for Using Check Stubs Effectively

To maximize the benefits of using check stubs in construction payroll management, consider the following tips:

-

Choose a Reliable Payroll System: Select a payroll software or service provider that meets the specific needs of your construction business, including compliance requirements and reporting capabilities.

-

Educate Employees: Ensure that employees understand how to read and interpret their check stubs. Provide explanations for common terms, deductions, and tax withholdings to promote transparency and reduce inquiries.

-

Regularly Review Payroll Reports: Conduct regular audits of payroll reports and check stubs to identify any discrepancies or errors promptly. Addressing issues promptly helps maintain accurate financial records and employee trust.

-

Stay Updated on Regulations: Keep abreast of changes in labor laws and regulations that may impact payroll processing and reporting requirements. Ensure that your payroll practices remain compliant to avoid penalties or legal liabilities.

Conclusion

In conclusion, free check stubs are invaluable tools for managing payroll in the construction industry. They provide transparency, accuracy, and compliance with labour laws while enhancing communication and trust between employers and employees. By adopting automated payroll systems that generate detailed check stubs, construction companies can streamline their payroll processes, improve efficiency, and maintain accurate financial records. Effective use of check stubs not only ensures compliance with regulatory requirements but also contributes to overall business success and employee satisfaction.

If you’re looking to streamline your construction payroll management and improve compliance, consider integrating digital check stubs into your payroll system.