How to Make Pay Stubs Online: A Comprehensive Guide

- Business

eformscreator

eformscreator- August 23, 2024

- 12

Creating accurate pay stubs is essential for both employers and employees. For employers, it ensures compliance with wage and hour laws, while for employees, it provides a clear record of earnings, deductions, and taxes withheld. With advancements in technology, making paystubs online has become easier and more accessible. In this guide, we will walk you through the process of creating pay stubs online, explore the benefits of using a paystub creator, and highlight how you can access free tools to streamline this process.

What is a Pay Stub?

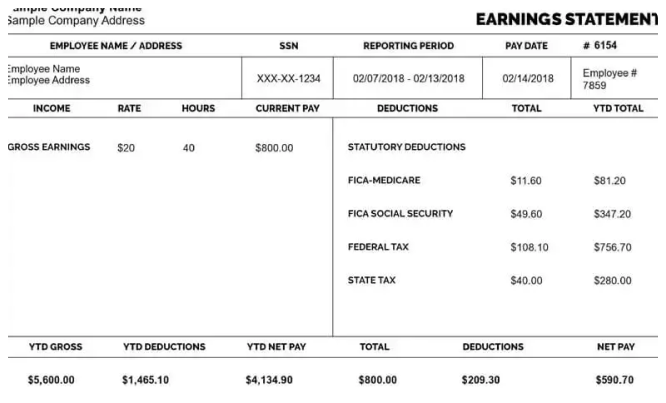

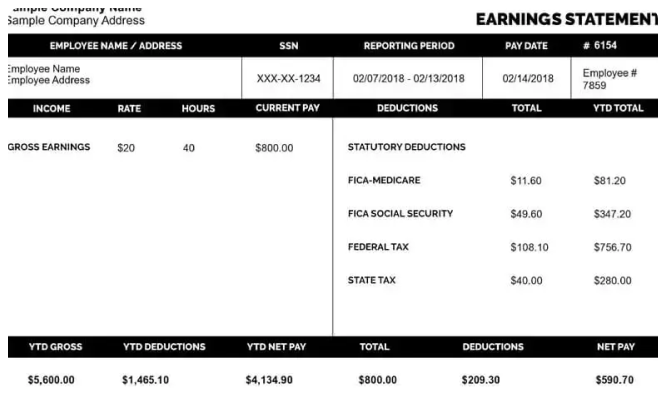

Before diving into how to create pay stubs online, it’s important to understand what a pay stub is and its components:

- Definition: A pay stub is a document provided by an employer that details an employee’s earnings for a specific pay period, including deductions, taxes, and other withholdings.

- Components: Key elements of a pay stub include:

- Gross Pay: Total earnings before any deductions.

- Net Pay: Amount received after deductions.

- Deductions: Includes taxes, insurance premiums, retirement contributions, etc.

- YTD (Year-To-Date): Total earnings and deductions for the year.

Benefits of Creating Pay Stubs Online

Creating pay stubs online offers several advantages:

- Convenience: Easily generate pay stubs from anywhere with internet access.

- Accuracy: Online tools help ensure that calculations are correct and up-to-date.

- Efficiency: Save time compared to manual methods and streamline payroll processing.

- Accessibility: Instant access to pay stubs for both employers and employees.

- Compliance: Helps maintain compliance with legal and regulatory requirements.

How to Make Pay Stubs Online: A Step-by-Step Guide

Here’s a detailed guide on how to create pay stubs online, from choosing the right tool to generating and reviewing your pay stubs:

1. Choose a Reliable Pay Stub Creator

To get started, you need a pay stub creator. Many online tools are available, and some are free. Here’s how to choose one:

- Reputation: Look for tools with positive reviews and a good reputation for accuracy and security.

- Features: Ensure the tool offers all necessary features, such as custom templates, automatic calculations, and support for various deduction types.

- User-Friendly: Choose a tool that is easy to navigate and use.

Free Pay Stub Creators: Some tools offer free versions with basic functionalities. These are ideal for occasional use or small businesses with straightforward needs.

2. Gather Necessary Information

Before creating a pay stub, collect the required information:

- Employee Details: Name, address, and Social Security number.

- Employer Details: Company name, address, and tax identification number.

- Earnings Information: Gross pay, hourly rate or salary, overtime, bonuses.

- Deductions: Taxes withheld, insurance premiums, retirement contributions, etc.

3. Enter Information into the Pay Stub Creator

Once you have chosen a pay stub creator, follow these steps:

- Sign Up or Log In: If required, create an account or log in to the pay stub creator tool.

- Select a Template: Choose a pay stub template that suits your needs. Many tools offer customizable templates.

- Input Employee and Employer Details: Enter the gathered information into the designated fields.

- Enter Earnings and Deductions: Input the gross pay, deductions, and any other relevant details.

- Review Calculations: Ensure the tool automatically calculates net pay and other totals correctly.

4. Generate and Save the Pay Stub

After entering all the required information:

- Generate Pay Stub: Click the “Generate” or “Create” button to produce the pay stub.

- Review the Pay Stub: Check for accuracy, including calculations and entered information.

- Save or Print: Save the pay stub as a PDF or print it for physical distribution. Ensure you keep a copy for your records.

5. Distribute Pay Stubs

Once the pay stubs are generated:

- For Employers: Distribute pay stubs to employees electronically or via physical copies.

- For Employees: Review your pay stub to ensure accuracy and keep it for your records.

Tips for Using a Free Pay Stub Creator

While free pay stub creators can be very useful, here are some tips to make the most out of them:

- Verify Accuracy: Double-check all entered information and calculations. Free tools may have limitations, so accuracy is key.

- Limitations: Be aware of any limitations or restrictions with free versions, such as fewer features or a limited number of pay stubs you can create.

- Security: Ensure that the tool you choose protects your data with strong security measures.

Common Issues and How to Resolve Them

Creating pay stubs online may come with challenges. Here are some common issues and how to address them:

- Incorrect Calculations: If the pay stub creator produces incorrect calculations, review your input data for errors and ensure the tool is up-to-date.

- Missing Information: If any information is missing from the pay stub, re-enter the details and regenerate the document.

- Technical Problems: For technical issues with the online tool, contact customer support or look for troubleshooting tips provided by the tool’s website.

FAQs

- Can I Use a Free Pay Stub Creator for Business Purposes?: Yes, but be mindful of the tool’s limitations and ensure it meets your business needs.

- How Often Should I Create Pay Stubs?: Pay stubs should be created for each pay period and provided to employees regularly.

- What Should I Do If I Notice an Error on a Pay Stub?: Correct the error using the pay stub creator and issue a revised pay stub if necessary.

- Are Online Pay Stub Creators Secure?: Choose reputable tools with strong security features to protect your data.

Conclusion

Creating pay stubs online is a convenient and efficient way to manage payroll, whether you’re an employer or an employee. By choosing a reliable paystub creator, entering accurate information, and reviewing the generated pay stubs, you can ensure that your financial records are accurate and up-to-date. Free pay stub creators offer a cost-effective solution for occasional use or small businesses, but always verify their accuracy and security.

For ongoing payroll needs or complex requirements, consider investing in a paid pay stub creator with advanced features.

For further assistance or additional resources, don’t hesitate to consult the customer support of your chosen pay stub creator or seek professional advice.

Read Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a McDonald’s Pay Stubs?