How to Clear Out Outstanding Checks in QuickBooks?

Converting outstanding checks in QuickBooks can be an essential part of maintaining accurate financial records. Outstanding checks are those that have been written but not yet cleared by the bank. If left unaddressed, they can lead to discrepancies in your financial statements and complicate the reconciliation process. In this blog post, we will explore how to effectively clear out outstanding checks in QuickBooks, ensuring your accounts remain balanced and up-to-date.

Understanding Outstanding Checks

Outstanding checks can arise for various reasons, such as a payee not cashing the check or a delay in processing. Regardless of the cause, it’s crucial to manage these checks to maintain accurate financial reporting. QuickBooks provides several methods for clearing outstanding checks, including creating journal entries or making deposits.

Steps to Clear Outstanding Checks in QuickBooks

1. Identify Outstanding Checks

To begin, you need to identify which checks are outstanding. You can do this by running a report:

- Go to the Reports tab.

- Select Check Detail under the Expenses section.

- Customize the report to filter for uncleared transactions.

This report will help you see all outstanding checks that need attention.

2. Create a Journal Entry

If you have a check that has not been cashed for an extended period, you may want to create a journal entry to clear it:

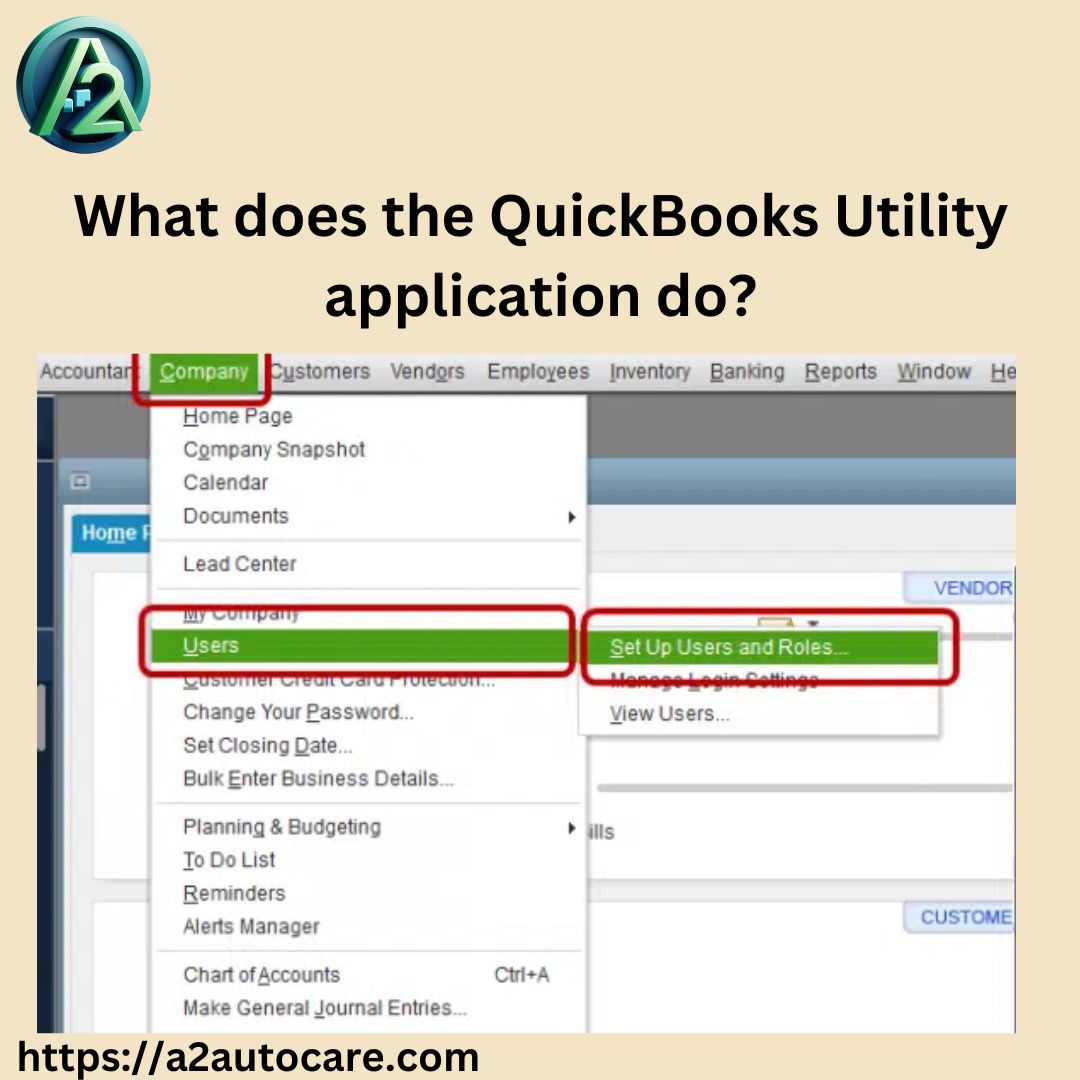

- Navigate to the Company menu and select Make General Journal Entries.

- Choose your bank account in the Account column.

- Enter the amount of the outstanding check as a debit.

- In the next line, select an appropriate expense account or an equity account for the credit entry.

- Add a memo explaining the transaction for future reference.

Consult with your accountant before making these entries to ensure compliance with accounting principles.

3. Voiding or Reissuing Checks

If a check has been outstanding for too long (usually six months), you may consider voiding it:

- Locate the check in your register.

- Right-click on the check and select Void Check.

- Record a new check if necessary, ensuring it reflects the correct details.

Alternatively, if you wish to reissue the payment, create a new standard check and mark both transactions as cleared during reconciliation.

4. Making Deposits for Uncashed Checks

For checks that have not been cashed but need to be cleared from your books:

- Create a bank deposit dated for the current year.

- Assign this deposit to an income account since it represents money that was never claimed by the payee.

- During your next reconciliation, clear this deposit against the old outstanding check.

This method helps keep your records accurate while ensuring no funds are lost.

Best Practices for Managing Outstanding Checks

- Regular Monitoring: Regularly review your outstanding checks report to prevent long-standing issues.

- Communicate with Payees: If possible, reach out to payees regarding uncashed checks to resolve any issues promptly.

- Consult Your Accountant: Always consult with your accountant when making significant adjustments to ensure compliance with accounting standards.

Conclusion!

Clearing out outstanding checks in QuickBooks is vital for maintaining accurate financial records. By following these steps—identifying outstanding checks, creating journal entries, voiding or reissuing checks, and making necessary deposits—you can ensure your accounts remain balanced. Regular monitoring and communication with payees will further enhance your financial management practices. With these strategies in place, you can confidently manage your outstanding checks and streamline your accounting processes.