How Do You Get an Unemployment Pay Stub?

Unemployment benefits provide crucial financial support during periods of job loss, but obtaining a detailed pay stub for these benefits can be a bit confusing. Unlike traditional employment, where pay stubs are provided directly by an employer, unemployment pay stubs come from different sources and might involve various processes depending on your state or country. This comprehensive guide explains how to obtain an unemployment pay stub, the role of a paystub generator, and what you need to know to manage your benefits effectively.

Understanding Unemployment Pay Stubs

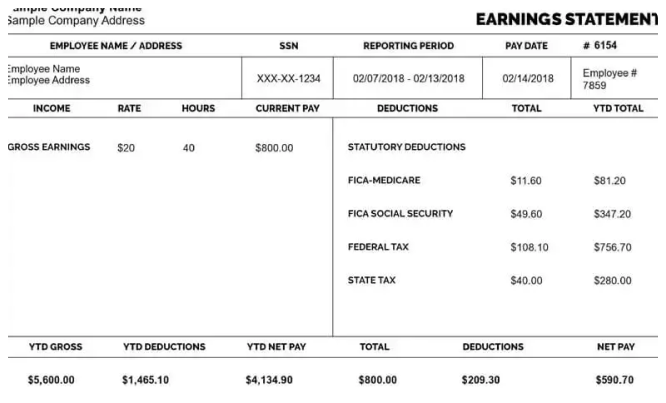

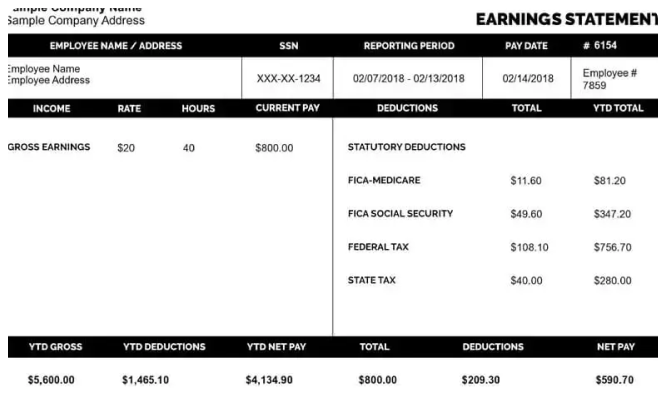

Unemployment pay stubs are documents that detail the amount of unemployment benefits you receive, similar to pay stubs from a regular job. These documents are essential for record-keeping, filing taxes, and verifying income. However, the process of obtaining them differs from traditional pay stubs.

Where to Get Your Unemployment Pay Stub

1. State Unemployment Insurance Office

- Online Portal: Most states provide an online portal where you can access and print your unemployment pay stubs. You will need to log in with your credentials to access your benefits information.

- Mail: In some states, you may receive paper statements by mail detailing your unemployment benefits. These documents typically include information about the benefit amount, payment dates, and other relevant details.

2. Unemployment Benefit Statement

- Weekly/Monthly Statements: Some states issue benefit statements weekly or monthly. These statements function similarly to pay stubs, detailing the amount of benefits paid, the period covered, and any deductions.

- Benefit History: You can usually access a comprehensive history of your unemployment benefits through the state unemployment office’s online portal, which can be downloaded or printed.

3. Employer Reporting

- Verification Forms: In some cases, employers are required to provide verification forms or documentation to the unemployment office. This information might include details about your previous employment and wages, which helps in calculating your unemployment benefits.

How to Obtain Your Unemployment Pay Stub

1. Log Into Your State’s Unemployment Portal

- Account Creation: If you haven’t already, create an account with your state’s unemployment insurance portal. You’ll need personal information, such as your Social Security number and other identification details.

- Navigate to Benefits Section: Once logged in, navigate to the section where you can view your benefits information or pay stubs. This is typically found under “Payment History” or “Benefit Statements.”

2. Requesting Documentation

- Online Requests: Use the online portal to request detailed statements or pay stubs if they are not readily available. There may be an option to generate and download documents.

- Customer Service: If you encounter difficulties accessing your pay stubs online, contact the unemployment office’s customer service for assistance. They can guide you through the process or provide alternative methods to obtain your documentation.

3. Check Your Mail

- Paper Statements: If your state sends paper statements, check your mail regularly for these documents. They will include detailed information about your unemployment benefits and payments.

Using a Paystub Generator for Unemployment Benefits

While a paystub generator is typically used for creating pay stubs from traditional employment, it can also be a helpful tool for managing and documenting unemployment benefits. Here’s how a paystub generator can assist:

1. Creating Detailed Records

- Benefit Details: Input your unemployment benefit details into a paystub generator to create a customized record of your payments. This can be useful for personal record-keeping and verifying income.

- Custom Templates: Use templates that allow you to include specific details about your unemployment benefits, such as payment dates and amounts.

2. Tax Filing and Verification

- Tax Documentation: A paystub generator can help you create records that are useful for tax filing. Include details about your unemployment benefits to ensure accurate reporting.

- Income Verification: Use generated pay stubs for verification purposes when applying for loans, rental agreements, or other financial transactions.

3. Organizing Financial Records

- Record Keeping: Maintain organized records of your unemployment benefits with the help of a paystub generator. This makes it easier to track your income and manage your finances during unemployment.

- Historical Data: Create historical records of your benefits to review past payments and ensure consistency with official statements.

Common Questions About Unemployment Pay Stubs

1. What information is typically included on an unemployment pay stub?

Unemployment pay stubs typically include the payment amount, period covered, payment date, and any deductions or adjustments. Some may also include the total amount of benefits received over a specific period.

2. Can I get a pay stub if I received unemployment benefits in the past?

Yes, you can usually access historical records of your unemployment benefits through the state unemployment portal. Look for sections related to past payments or benefit history.

3. What should I do if I can’t access my unemployment pay stubs?

If you have trouble accessing your pay stubs, contact the unemployment office’s customer service for assistance. They can help you access your records or provide alternative methods to obtain the documentation.

4. How can a paystub generator help with unemployment benefits?

A paystub generator can help create detailed records of your unemployment benefits, assist with tax filing, and provide organized financial documentation. It’s a useful tool for managing and verifying your benefits.

Tips for Managing Unemployment Benefits

1. Stay Organized

- Track Benefits: Keep detailed records of your unemployment benefits and payments. Use tools like paystub generators to create organized records.

- Review Statements: Regularly review your benefit statements for accuracy and to ensure that you receive the correct amount.

2. Communicate with Your Unemployment Office

- Report Issues: If you encounter any discrepancies or issues with your benefits, promptly report them to the unemployment office for resolution.

- Seek Assistance: Don’t hesitate to contact customer service if you need help with accessing documents or understanding your benefits.

3. Prepare for Tax Season

- Documentation: Ensure that you have all necessary documentation for tax filing, including records of unemployment benefits. Use paystub generators to create accurate records.

- Consult Professionals: Consider consulting a tax professional if you have questions about how unemployment benefits impact your taxes.

Conclusion

Obtaining an unemployment pay stub involves navigating state-specific processes and understanding how unemployment benefits are documented. By using your state’s unemployment portal, requesting documentation as needed, and leveraging tools like a Free paystub generator, you can effectively manage your benefits and maintain accurate financial records. Staying organized and informed will help you navigate the unemployment process smoothly and ensure that you receive the support you need during this period.