How Do You Figure the Value of a Business?

Ever wondered how much a business is worth? Whether you’re buying, selling, or just plain curious, understanding a business’s value is crucial. It’s not just about crunching numbers; it’s about considering the market, the assets, and even future potential. Let’s dive into what makes this process tick.

What Is Business Valuation?

Business valuation is like finding the price tag for a company. It’s the process of determining the economic value of a business. This is vital for mergers, acquisitions, partnerships, and even tax planning. Basically, whenever money or ownership is involved, valuation becomes a priority.

Key Factors That Influence Business Value

-

Financial Performance

The healthier the finances, the higher the value. Revenue, profits, and expense management are key indicators. -

Market Conditions

Is the industry booming or declining? External factors like competition and consumer demand also play a big role. -

Tangible and Intangible Assets

Physical assets like equipment and intangible ones like brand reputation both impact the valuation.

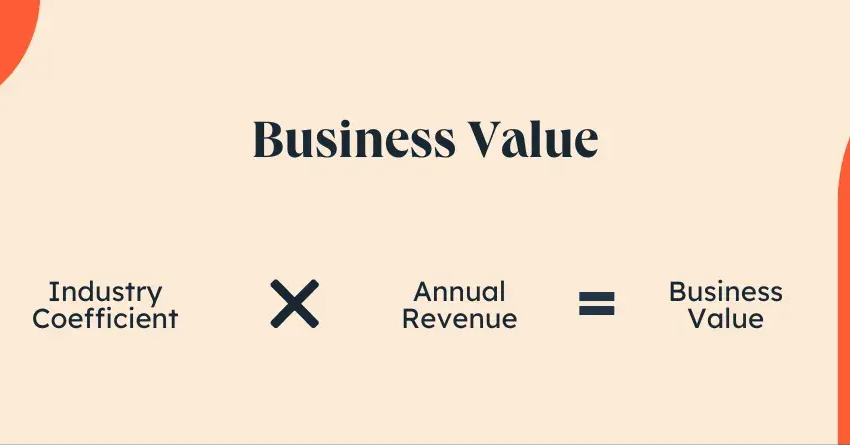

Types of Business Valuation Methods

Understanding different valuation methods is like having a toolbox. Each tool is suited for specific tasks. The three main approaches are:

1. Asset-Based Approach

Looks at the business’s assets and liabilities.

2. Market Value Approach

Compares the business to similar ones that have been sold.

3. Income Approach

Focuses on future earning potential, using projections and profitability.

Understanding the Asset-Based Approach

This method is straightforward. Add up all tangible assets like buildings, inventory, and equipment. Then subtract liabilities. The result is the net asset value. This works best for businesses with significant physical assets.

Exploring the Market Value Approach

This is like house hunting. You check what similar businesses in the market are worth. However, finding a perfect comparison can be tricky, especially for unique or niche companies.

Delving Into the Income Approach

The income approach takes future earnings into account. Using the Discounted Cash Flow (DCF) method, you project profits over a period and adjust for present-day value. It’s a favorite for businesses with consistent revenue.

The Role of Financial Statements in Business Valuation

Financial statements are your roadmap. Accurate records of income, expenses, and debts give a clear picture. Key documents include:

-

Balance sheets

-

Income statements

-

Cash flow statements

How Market Trends Impact Business Value?

An industry’s health directly impacts valuation. A growing industry usually means a higher value. Economic downturns or new regulations can, however, pull that value down.

Valuing Intangible Assets

Intangible assets can be game-changers. A strong brand, patented technology, or even a loyal customer base adds significant value.

Common Mistakes in Business Valuation

-

Ignoring liabilities hidden in fine print.

-

Overestimating future growth.

-

Relying too much on a single valuation method.

Using Professional Valuation Services

Experts bring objectivity and experience. They provide detailed reports and accurate assessments, which can be crucial for complex businesses.

Conclusion

Figuring out a business’s value isn’t a one-size-fits-all process. It requires understanding the business’s assets, market trends, and future earning potential. Whether you’re a buyer, seller, or owner, knowing the true value of a business is invaluable.