How a Check Stub Maker Can Simplify Payroll for Hourly Workers

In today’s fast-paced world, managing payroll can be a daunting task, especially for businesses that employ hourly workers. As an employer, ensuring that your employees are paid accurately and on time is crucial not only for morale but also for maintaining compliance with labour laws. Thankfully, technology has come to the rescue. One of the most effective tools for simplifying payroll is a check stub maker. In this blog post, we’ll explore what check stubs are, how they work, and why using a check stub maker can significantly ease the payroll process for hourly workers.

Understanding Check Stubs

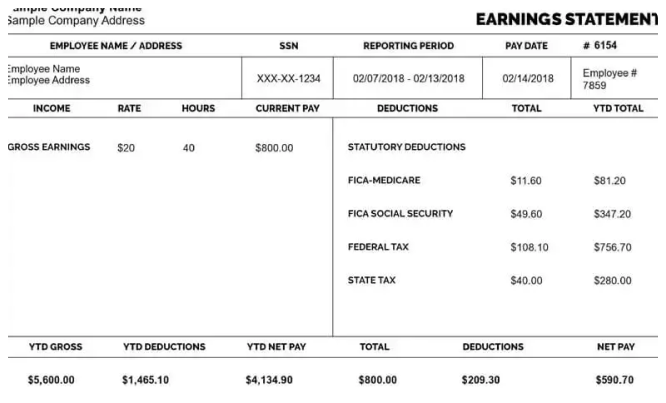

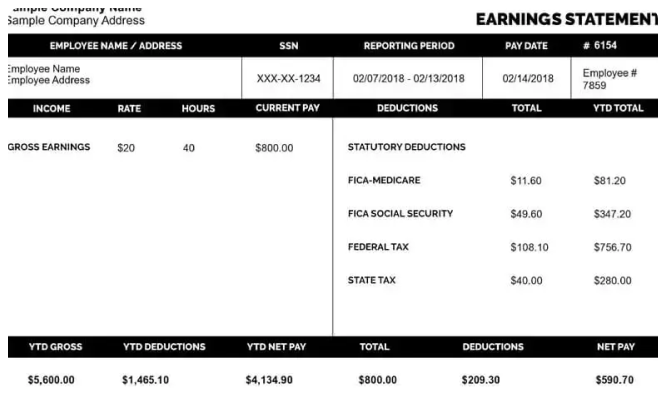

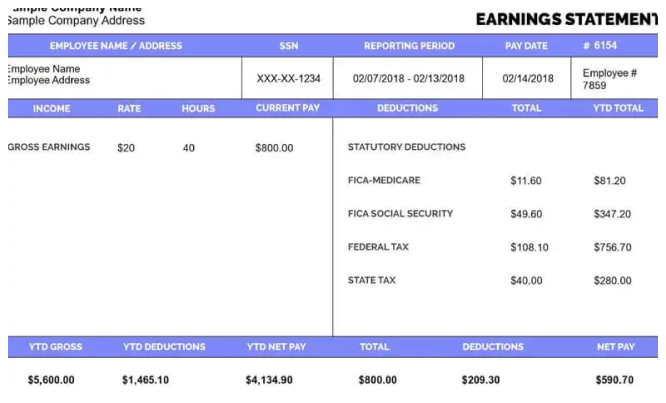

Before diving into the benefits of a check stub maker, let’s first clarify what a check stub is. A check stub is a document that accompanies a paycheck, providing a detailed breakdown of an employee’s earnings for a specific pay period. It typically includes information such as:

- Gross pay: The total earnings before any deductions.

- Deductions: Amounts taken out for taxes, health insurance, retirement contributions, and other withholdings.

- Net pay: The amount the employee takes home after deductions.

- Hours worked: The total number of hours worked during the pay period.

- Employee and employer information: Names, addresses, and identification numbers.

For hourly workers, this document is especially important as it not only shows how much they earned but also helps them keep track of their hours worked and any deductions that have been made.

The Importance of Accurate Check Stubs

Accurate check stubs are essential for both employees and employers. Here are a few reasons why:

1. Transparency

Hourly workers need to see exactly how their pay is calculated. This transparency helps build trust between the employer and employees. When workers can easily access their check stubs, they feel more secure in their compensation.

2. Record Keeping

Check stubs serve as important records for employees. They can help workers track their income for budgeting and financial planning. Additionally, these documents can be necessary for tax purposes, loan applications, and other financial dealings.

3. Compliance

Employers must comply with various labor laws, including proper wage reporting. Providing accurate check stubs helps ensure that businesses are meeting their legal obligations and reduces the risk of disputes.

How a Check Stub Maker Works

A check stub maker is an online tool that simplifies the process of creating check stubs. Here’s how it works:

-

Input Information: Users enter relevant details such as employee name, hours worked, pay rate, and any deductions. Most check stub makers have user-friendly interfaces that make data entry straightforward.

-

Automatic Calculations: The software automatically calculates gross pay, deductions, and net pay based on the information provided. This eliminates the risk of human error in calculations.

-

Template Selection: Many check stub makers offer various templates to choose from, allowing businesses to customize the appearance of their check stubs according to their branding.

-

Download and Print: Once all information is entered and reviewed, users can download the check stub as a PDF or other formats. They can then print it out or send it electronically to employees.

Benefits of Using a Check Stub Maker

1. Time Efficiency

Creating check stubs manually can be a time-consuming process. By using a check stub maker, employers can save time that can be better spent on other important business activities. The automatic calculations and template options speed up the entire process.

2. Cost-Effective

For small businesses, hiring a payroll service can be expensive. A check stub maker is a cost-effective alternative that provides the necessary tools to generate professional check stubs without the need for additional payroll staff.

3. Error Reduction

Human errors in payroll can lead to significant issues, including overpayments or underpayments. By automating calculations, a check stub maker helps reduce these errors, ensuring employees are paid accurately.

4. Professional Appearance

A check stub maker produces high-quality, professional-looking stubs. This enhances the credibility of the business and assures employees that they are working for a reputable company.

5. Accessibility

Many check stub makers operate in the cloud, allowing users to access the software from anywhere with an internet connection. This is particularly useful for businesses with remote employees or multiple locations.

6. Customization

Most check stub makers allow users to customize the stubs to fit their branding needs. This could include adding company logos, changing colours, and selecting different layouts, making each check stub unique to the business.

7. Easy Record-Keeping

Using a check stubs maker makes it simple to keep electronic records of past pay periods. This can be beneficial for tracking employee income over time, which can help with budgeting and financial planning.

8. Simplifies Communication

Having clear and accurate check stubs can help reduce confusion and questions from employees regarding their pay. If workers can easily reference their check stubs, it streamlines communication between them and management.

Best Practices for Using a Check Stub Maker

To get the most out of a check stub maker, consider the following best practices:

1. Regular Updates

Ensure that the check stub maker software is regularly updated. This will help incorporate any changes in tax laws or payroll regulations that could affect your check stubs.

2. Input Accurate Data

Always double-check the data entered into the check stub maker. Even though the software reduces errors, providing accurate and complete information is crucial for creating correct stubs.

3. Educate Employees

Educate your employees about how to read and understand their check stubs. This not only helps them grasp their pay details but also empowers them to take charge of their finances.

4. Back-Up Records

Keep a backup of all generated check stubs. While most check stub makers will save your records, having a personal backup can prevent data loss due to technical issues.

5. Seek Feedback

After implementing a check stub maker, seek feedback from your employees. Their insights can help you refine your payroll process and ensure that their needs are being met.

Conclusion

In the complex world of payroll management, a check stub maker emerges as a powerful tool for simplifying the process for hourly workers. With its ability to streamline calculations, reduce errors, and produce professional check stubs, it offers a cost-effective solution for businesses of all sizes. By leveraging a check stub maker, employers can not only enhance their payroll efficiency but also foster transparency and trust with their hourly workers.

Investing in a check stub maker is more than just a business decision; it’s about valuing your employees and ensuring they are compensated accurately and on time. So, why not give it a try and see the difference it can make for your payroll process?