How a Check Stub Maker Can Help Tech Companies Manage Equity and Bonuses

In today’s tech industry, managing payroll goes beyond just paying a regular salary. Many tech companies offer additional compensation like equity and bonuses to attract top talent and reward performance. These extra forms of compensation, while valuable, can add complexity to the payroll process—especially for companies dealing with multiple employees in different roles and locations.

One solution that helps simplify this process is a free check stubs maker. This tool not only helps automate payroll but also enables companies to accurately manage and document employee earnings, including equity and bonuses. In this blog, we’ll discuss how a check stubs maker can support tech companies in managing these unique compensation elements.

Understanding Equity and Bonuses in the Tech Industry

In tech, compensation packages often include a mix of base salary, bonuses, and equity. Here’s a quick overview of each:

-

Equity: This is usually offered in the form of stock options, restricted stock units (RSUs), or similar investment vehicles that give employees an ownership stake in the company. Equity compensation can be a powerful incentive, as it aligns employees’ interests with the company’s long-term success.

-

Bonuses: Bonuses are typically awarded based on performance, company profit, or project milestones. They can be one-time rewards or scheduled (such as annual or quarterly bonuses) and are often a significant part of a tech employee’s income.

While these incentives are beneficial, they can create extra work for payroll teams. Each type of compensation has its own tax rules and regulations, and keeping track of these accurately is essential. Here’s where a check stubs maker comes in handy.

What is a Check Stubs Maker?

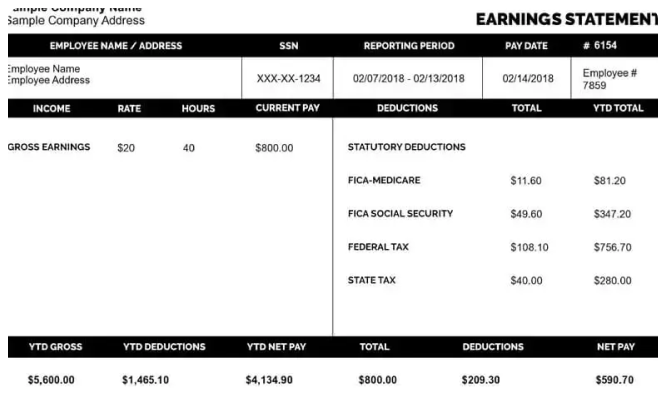

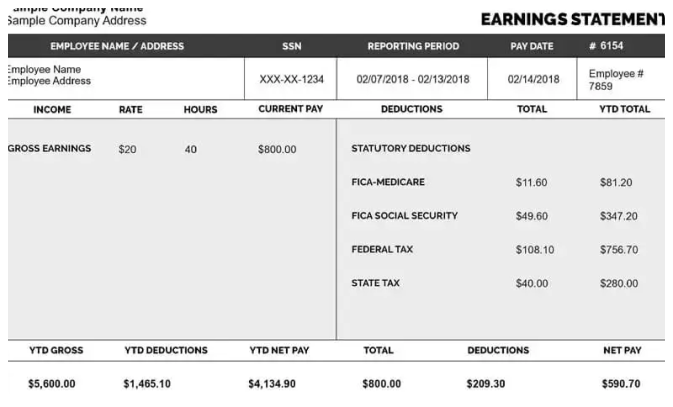

A check stubs is a tool or software that automates the process of generating check stubs, which are records of an employee’s earnings and deductions. A check stub includes important information such as:

- Gross pay

- Taxes withheld

- Deductions (e.g., health insurance, retirement contributions)

- Net pay (take-home amount)

- Additional compensation (e.g., bonuses and equity distributions)

For tech companies that regularly issue bonuses and equity, a check stubs maker can help keep these earnings organized and transparent for both the employer and the employee. This tool can simplify record-keeping and ensure employees have clear, accurate documentation of their pay and additional compensation.

Benefits of Using a Check Stubs Maker for Managing Equity and Bonuses

Using a check stubs maker offers multiple advantages for tech companies managing payroll with equity and bonuses. Let’s look at these benefits in more detail.

1. Simplified Tracking of Bonuses

With a check stubs maker, companies can easily add bonuses to employees’ paychecks. Instead of manually calculating each employee’s bonus, the tool allows employers to input the bonus amount and automatically adjusts the gross pay, taxes, and net pay. This feature is especially valuable for tech companies that frequently reward employees for achievements or project milestones.

For example, if a software development team meets a key deadline, the company might give each team member a performance bonus. By using a check stubs maker, payroll teams can record these bonuses accurately, ensuring employees see their extra earnings reflected on their pay stubs.

2. Accurate Documentation of Equity Distributions

Equity compensation adds a unique layer to payroll, as it typically doesn’t follow the same structure as a regular paycheck. Equity might be awarded on a vesting schedule, which means employees earn shares over time. When shares vest or are exercised, they often become taxable events.

A check stubs maker can help tech companies document equity distributions accurately. By including equity-related information on a check stub, employers can provide employees with a clear record of how much equity has vested, what it’s worth, and any associated tax implications. This transparency helps employees understand the full value of their compensation and can prevent confusion or disputes over equity earnings.

3. Automatic Tax Calculations

Taxes can be particularly complex when dealing with bonuses and equity. In many cases, bonuses are taxed at a different rate than regular income, and equity distributions may trigger capital gains taxes.

A check stubs maker can automatically calculate the necessary tax deductions for both bonuses and equity, ensuring compliance with tax laws. This helps reduce errors and potential penalties associated with incorrect tax filings. For employees, it also provides reassurance that their tax withholdings are accurate, allowing them to plan their finances with confidence.

4. Easy Access to Comprehensive Pay Details

In the tech industry, employees are often highly engaged in understanding their total compensation, including salary, bonuses, and equity. A check stubs maker provides employees with a single document that shows all elements of their earnings, deductions, and taxes.

By having access to a detailed check stub, employees can see exactly how much they earned from each component of their compensation package. This transparency fosters trust and ensures employees feel valued for their work, as they can see a breakdown of their achievements directly reflected in their pay.

5. Streamlined Record-Keeping and Compliance

For tech companies, staying compliant with payroll regulations is essential, particularly when managing unique forms of compensation. A check stubs maker helps maintain accurate records of all earnings, taxes, and deductions, ensuring that companies meet regulatory requirements.

Having organized, digital records of payroll data is also beneficial for audits or reviews. If a company is audited, these records are easily accessible and demonstrate that the company has documented all employee earnings accurately, including bonuses and equity distributions.

6. Increased Payroll Efficiency

Payroll processing can be time-consuming, especially when bonuses or equity compensation are involved. A check stubs maker simplifies this process, allowing payroll teams to process payments quickly and accurately. This is especially helpful for smaller tech companies that may not have a large HR or payroll department.

With a check stubs maker, there’s no need to manually enter payroll data or calculate taxes, which reduces the chances of mistakes and frees up time for payroll staff to focus on other important tasks.

How to Use a Check Stubs Maker for Equity and Bonus Management

Now that we understand the benefits, let’s go through how a tech company can use a check stubs maker to manage equity and bonuses effectively.

Step 1: Set Up Employee Profiles with Compensation Details

Start by setting up employee profiles in the check stubs maker tool. Include basic details such as:

- Name and contact information

- Role or department

- Base salary or hourly rate

- Bonus structure (if applicable)

- Equity type (stock options, RSUs, etc.)

For tech employees with equity, include details about vesting schedules or exercise prices so the check stubs maker can accurately reflect these components when they’re due.

Step 2: Input Bonus and Equity Data

When it’s time to process payroll, input any bonus amounts or equity distributions into the check stubs maker. For bonuses, simply enter the amount, and the tool will automatically adjust the earnings and taxes. For equity, input any vesting details or stock values to document them on the check stub.

Step 3: Review Tax Calculations

Before finalizing, review the tax calculations for accuracy. A check stubs maker will automatically calculate federal, state, and any applicable local taxes, but it’s a good idea to double-check to ensure compliance, especially if there are equity distributions.

Step 4: Generate and Distribute Pay Stubs

Once all data is entered, the check stubs maker will generate pay stubs that include details of the base salary, bonus, equity distributions, and tax deductions. Employees can receive these pay stubs electronically, allowing them to access all their compensation information in one place.

Step 5: Store Records for Compliance

After payroll is processed, save all check stubs digitally for record-keeping. This documentation can be useful for future reference, particularly if there are questions about bonuses or equity distributions. Digital records also simplify the process in case of an audit or compliance review.

Choosing the Right Check Stubs Maker for Your Tech Company

When selecting a check stubs maker for managing equity and bonuses, look for a solution with features tailored to the tech industry’s needs. Consider options that offer:

- Customizable fields: So you can add equity and bonus details.

- Accurate tax calculations: To handle complex payroll taxes associated with bonuses and equity.

- Secure, digital storage: To keep employee data safe and compliant.

- Integration capabilities: So it can work seamlessly with your existing payroll or HR software.

Conclusion

Managing payroll in tech companies can be challenging, especially when dealing with bonuses and equity compensation. A check stubs maker is a valuable tool that simplifies this process, helping payroll teams calculate, document, and distribute all forms of compensation accurately and efficiently.

By using a check stubs maker, tech companies can reduce errors, ensure compliance, and provide their employees with clear, detailed records of their pay. This transparency not only improves payroll accuracy but also strengthens the relationship between employers and employees, as it provides a clear view of how each employee’s hard work is rewarded.