Boosting Efficiency: Using a Free Payroll Check Maker in Construction

- Business

eformscreator

eformscreator- January 7, 2025

- 4

In the fast-paced world of construction, managing payroll can be a complex task. Construction projects often involve a large number of employees, varying work hours, overtime, and union pay scales. Getting the payroll process right is crucial not only for ensuring workers are paid accurately but also for avoiding costly errors that can harm your reputation and budget.

A free payroll check maker can be a game changer for construction businesses, especially for those looking for an affordable yet effective way to streamline payroll management. In this blog, we’ll explore how using a free payroll check maker can boost efficiency, improve accuracy, and save time for construction companies.

The Challenges of Payroll in the Construction Industry

Managing payroll in construction comes with a unique set of challenges. Unlike traditional office jobs where employees have regular working hours and set salaries, construction workers may have fluctuating hours, varying pay rates depending on the type of work, overtime, and different types of deductions like union fees, benefits, and tax withholdings.

Some specific payroll challenges in the construction industry include:

-

Varying Pay Rates: Workers may have different pay rates depending on their role, skills, certifications, or the project they are working on. For example, a certified electrician might earn more than a general laborer.

-

Multiple Work Sites: Many construction companies manage several job sites at once, each with its own set of employees. Keeping track of hours worked across multiple sites can be time-consuming and error-prone.

-

Overtime Pay: Construction work often involves overtime, especially if there are tight deadlines or unexpected delays. Ensuring overtime hours are calculated correctly and paid at the appropriate rate is essential for compliance.

-

Union Deductions: Construction workers who are part of a union may have additional deductions for union dues or benefits, which need to be accurately reflected in their paychecks.

-

Seasonal Variations: Construction work can be seasonal, with employees working more during the warmer months and fewer hours in the off-season. This fluctuation can complicate payroll processing.

These complexities make accurate payroll management essential in the construction industry. A free payroll check maker can help streamline the payroll process and reduce the potential for errors.

What is a Free Payroll Check Maker?

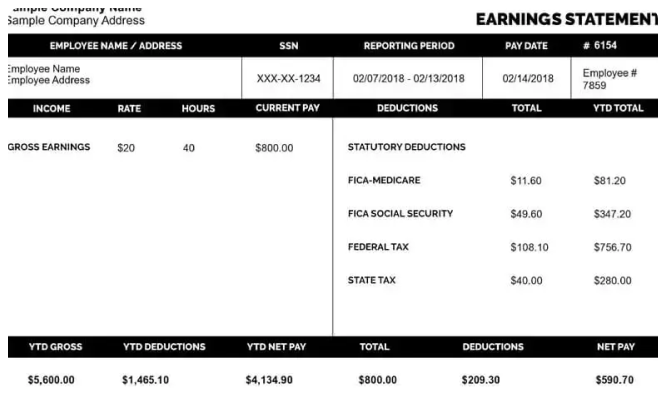

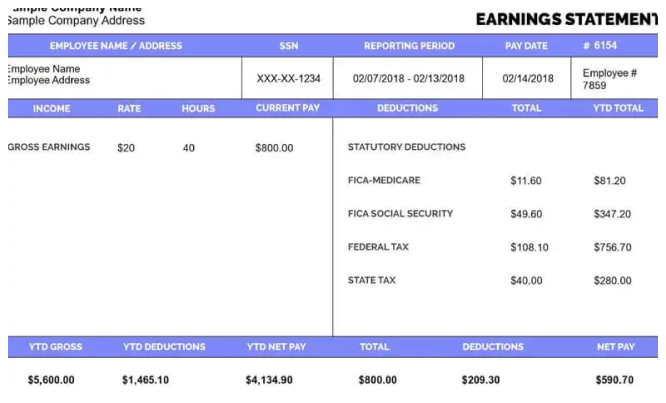

A free payroll check maker is a tool that allows businesses to generate professional payroll checks quickly and easily. It eliminates the need for manually writing checks or dealing with complex payroll software. By entering key information such as employee hours worked, pay rates, deductions, and overtime, the tool automatically generates a pay stub and payroll check that is ready for printing.

For construction businesses, a free payroll check maker simplifies the process of creating checks for each employee, ensuring that calculations are accurate, and payroll is processed efficiently. It can also generate digital records of paychecks for easy tracking and reporting.

How a Free Payroll Check Maker Improves Efficiency in Construction

Now that we understand the challenges of payroll in the construction industry and what a free payroll check maker is, let’s dive into how it can help improve efficiency in construction businesses.

1. Automated Calculations for Accuracy

Manual payroll calculations are prone to human error, especially when dealing with complex pay rates, varying work hours, and overtime. A free payroll check maker automates these calculations, ensuring that each paycheck is accurate every time.

For example, if an employee works overtime, the payroll check maker will automatically apply the correct overtime rate (usually 1.5x or more) to the hours worked beyond the standard workweek. Similarly, it will calculate taxes, benefits, and union deductions with ease, saving you from the risk of making costly mistakes.

By automating these calculations, construction businesses can reduce errors and improve accuracy, making sure employees are paid fairly and correctly.

2. Saves Time on Payroll Processing

The construction industry is often a busy and fast-paced environment, with workers frequently moving from one project to another. Payroll can become a time-consuming task, especially if it’s handled manually.

A free payroll check maker significantly reduces the time it takes to process payroll. Instead of manually writing checks, calculating hours, and figuring out deductions, you can simply input the necessary information into the tool and let it handle the rest. This allows payroll administrators to focus on other important tasks, such as managing projects or overseeing safety on job sites.

The quicker payroll processing is, the more time construction businesses can devote to other important aspects of their operations.

3. Simplifies Payroll for Multiple Job Sites

In construction, it’s common to have workers spread across multiple job sites. Managing payroll for employees working at different locations can be a headache, especially when tracking hours worked, job assignments, and rates of pay.

A free payroll check maker helps simplify this process by allowing you to track hours and pay for each individual worker, no matter where they are working. You can create payroll checks for each employee based on the hours worked at different job sites, ensuring that all work is accounted for and paid properly.

This streamlined approach makes it easier for businesses to manage payroll across multiple projects without the risk of confusion or errors.

4. Ensures Compliance with Tax and Legal Requirements

In the construction industry, businesses must comply with various tax and labor laws. Incorrect tax calculations or failure to deduct union fees or benefits can lead to serious consequences, including fines or audits.

A free payroll check maker ensures that all necessary tax deductions, such as federal, state, and local taxes, are automatically calculated and deducted. It also ensures that any additional deductions—such as union dues or retirement plan contributions—are accurately applied.

By using a free payroll check maker, construction companies can be confident that they are meeting all legal requirements, minimizing the risk of non-compliance.

5. Improves Record Keeping and Reporting

In the construction industry, good record-keeping is essential for both tax reporting and tracking employee hours worked. A free payroll check maker generates detailed pay stubs for each employee, which can serve as an official record of hours worked, pay rates, and deductions.

These records are helpful in case of disputes or audits. Employees can also use their pay stubs as proof of income for loans or other financial purposes.

Additionally, digital payroll records can be easily stored, tracked, and accessed at any time. Many free payroll check makers allow you to export payroll data into spreadsheets or accounting software, making it easier to generate reports for tax filings, project budgets, or labor cost analysis.

6. Boosts Employee Satisfaction

Employees who are paid accurately and on time are more likely to be satisfied with their jobs. A free payroll check maker ensures that workers in the construction industry receive accurate pay for the hours they worked, including overtime, shift premiums, and other applicable benefits.

Employees appreciate having clear, professional pay stubs that outline how their pay is calculated, including any deductions. This transparency helps build trust between employers and employees, leading to higher job satisfaction and retention.

A free payroll check maker can also help reduce employee complaints about payroll discrepancies, as they can easily review their pay stubs to verify the accuracy of their earnings and deductions.

7. Cost-Effective Solution

For small and medium-sized construction businesses, using a free payroll check maker is a cost-effective solution compared to hiring expensive payroll services or investing in complex payroll software. Many payroll check makers offer free basic versions with the option to upgrade for additional features.

By using a free payroll check maker, construction businesses can reduce overhead costs while still ensuring accurate and efficient payroll management. This can be especially beneficial for companies working with tight margins or in competitive bidding situations.

8. Digital Paychecks for Convenience

A free payroll check maker often comes with the option to generate digital paychecks, which employees can access through an online portal or email. This digital format is convenient for employees, especially those who may not be in the office every day or work in remote areas.

Employees can view their pay stubs online, download them for their records, or use them to file taxes. Digital paychecks also reduce the need for printing physical checks, which saves money on paper, ink, and postage.

How to Choose the Right Free Payroll Check Maker for Your Construction Business

When selecting a free payroll check maker for your construction business, consider the following factors:

-

Ease of Use: Choose a tool that is easy to use, even for those with little payroll experience. Look for a simple interface with clear instructions.

-

Customization Options: Ensure the tool allows for customization based on your construction company’s unique payroll needs, such as different pay rates for various roles or job sites.

-

Tax and Deduction Calculations: The tool should automatically calculate federal, state, and local taxes, as well as any union or benefit deductions.

-

Record Keeping: Choose a tool that generates detailed pay stubs and allows for easy record-keeping and report generation.

-

Customer Support: Opt for a free payroll check maker that offers customer support in case you run into any issues during payroll processing.

Conclusion

A free payroll check maker is an invaluable tool for construction businesses looking to improve payroll accuracy, streamline processes, and reduce errors. With the ability to automate calculations, manage multiple job sites, ensure compliance, and improve employee satisfaction, this tool can boost efficiency across your entire payroll operation.

For construction businesses, where accuracy and timeliness are key to maintaining employee trust and staying compliant with labor laws, using a free payroll check maker is a smart, cost-effective solution.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important