Are Check Stub Makers Legal? What You Need to Know

In the world of finances and payroll, one tool that has gained significant popularity is a check stubs maker. Whether you’re a freelancer managing your income or a small business owner paying your employees, these online tools can simplify the process of generating pay stubs. But with their increasing use, many people wonder: Are check stubs makers legal? Can they be trusted for accurate and legitimate pay stubs?

In this blog, we’ll address these questions and cover everything you need to know about the legality of check stub makers. From understanding what a check stub is, to the legal aspects surrounding them, we’ll guide you through what you should consider when using these tools to create pay stubs. By the end, you’ll have a clear picture of how these tools work and how to use them responsibly.

What Is a Check Stub?

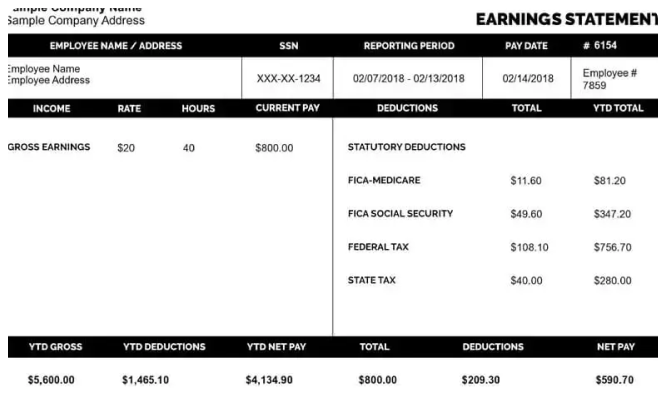

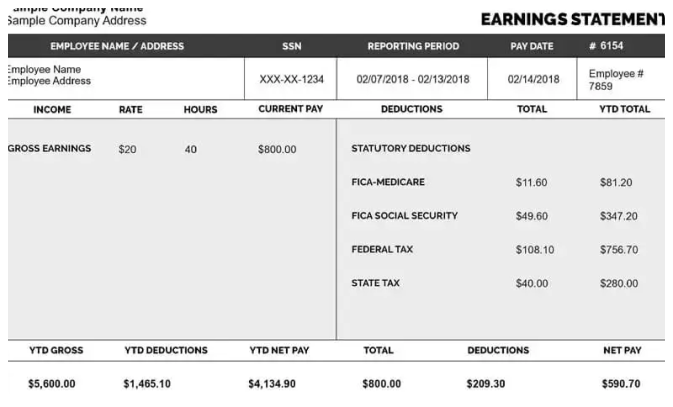

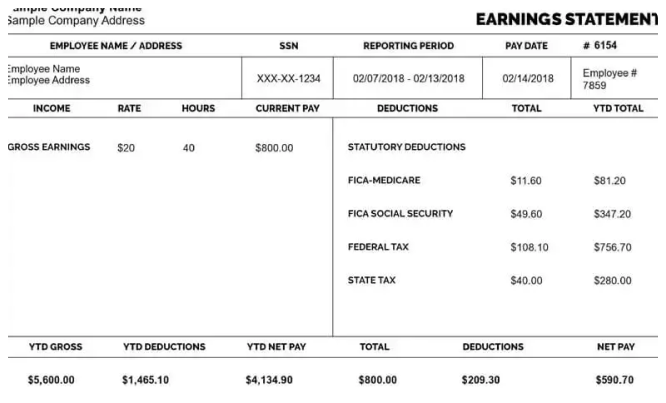

Before diving into the legality, let’s first clarify what a check stub is. A check stub, also known as a pay stub or paycheck stub, is a document that provides a breakdown of an employee’s earnings and deductions for a given pay period. This document typically includes:

- Gross pay: The total amount earned before deductions.

- Deductions: The amounts taken out for taxes, benefits, insurance, and other withholdings.

- Net pay: The final amount that an employee receives after deductions.

- Employer and Employee Information: This includes names, addresses, and other relevant details.

Employers traditionally provide check stubs to employees alongside their paycheck to ensure transparency in compensation and deductions. However, for freelancers and small business owners, generating these stubs can sometimes be challenging—this is where check stubs makers come in.

What Is a Check Stubs Maker?

A Free check stubs maker is an online tool or software that allows individuals and businesses to generate professional pay stubs. These tools simplify the process of creating pay stubs by offering templates that you can fill in with information like gross pay, deductions, and net pay. They automatically calculate the correct amounts and generate a finished document that looks just like a traditional pay stub.

Check stubs makers are especially useful for freelancers, contractors, and small business owners who need to generate pay stubs for clients or employees but do not have access to an official payroll service.

Are Check Stub Makers Legal?

Now, let’s address the most important question: Are check stubs makers legal?

The short answer is yes, check stubs makers are legal to use in most cases. However, it’s important to understand the nuances of their legality. Using a check stub maker is perfectly fine as long as the information entered is truthful and accurate. In other words, as long as you’re using a check stub maker to create legitimate pay stubs based on actual earnings, the tool itself is legal.

Here are a few things to keep in mind when using a check stub maker:

1. Accuracy of Information

The legality of a check stub maker hinges on the accuracy of the information you input. These tools can only generate pay stubs based on the data you provide. If you enter false or inaccurate information, the pay stub will also be incorrect, which could lead to legal issues. For instance, if you falsify your income on a pay stub (for example, for a loan application), this can be considered fraudulent activity, which is illegal.

To avoid legal trouble:

- Always enter accurate, truthful information when using a check stub maker.

- Ensure your pay stubs reflect the actual wages earned and appropriate deductions.

- Do not use a check stub maker to create fake pay stubs for illegal purposes (such as misrepresenting your income or avoiding taxes).

2. Purpose of Use

The check stub maker tool itself is not illegal, but how you use it is important. Using a check stub maker to generate pay stubs for legitimate purposes—such as managing your finances, keeping track of payments, or providing proof of income—is perfectly legal.

However, using these tools to create false documents for purposes such as applying for a loan or credit under false pretenses is illegal. Misusing check stubs makers for fraudulent activity could lead to serious consequences, including criminal charges.

3. Legal Considerations for Employers

If you’re a small business owner or employer using a check stub maker to generate pay stubs for employees, there are some important legal considerations to keep in mind:

- Compliance with Labor Laws: Employers are required to comply with various labor laws, including providing employees with pay stubs or wage statements. While the specific requirements for pay stubs vary by state, your check stub maker must include all necessary information, such as the gross pay, deductions, and net pay.

- State-Specific Requirements: Different states have different rules regarding the information that must appear on pay stubs. Some states, such as California, have more stringent requirements than others. Ensure that the check stub maker you use allows you to include all required information to meet your state’s legal requirements.

- Record Keeping: Employers are required to keep accurate payroll records for a certain period, usually several years. Using a check stub maker to generate pay stubs can help you keep digital records for easy reference and ensure compliance with tax and labor regulations.

4. Online Tools and Security

While check stubs makers are legal, it’s essential to choose a reputable, secure service. Many check stubs makers operate online, which means you’ll need to enter sensitive information, such as your income, tax deductions, and employee details. Before using any tool, check for security features, such as:

- SSL encryption: This ensures that your information is transmitted securely.

- Data privacy policies: Ensure that the service protects your personal and financial information and does not sell or misuse your data.

- Reputation: Research the service or tool to ensure it has a good reputation and positive reviews.

By using a reputable, secure check stub maker, you can avoid the risk of your data being compromised or misused.

5. Use by Freelancers and Contractors

Freelancers and contractors often need to create pay stubs for their own records or to provide proof of income. Using a check stub maker for this purpose is completely legal as long as the information you input is accurate. Freelancers typically do not have an employer providing pay stubs, which makes these tools an excellent solution for generating professional documents that can be used for:

- Tax purposes: Freelancers can use pay stubs to track their income and expenses for tax filings.

- Loan applications: If you’re applying for a loan, some lenders may ask for proof of income, and a check stub maker can help you create a document to satisfy that requirement.

- Client invoicing: Contractors can also use check stubs makers to send pay stubs to clients as part of their invoicing process.

As with all tools, ensure that the pay stub reflects accurate earnings and deductions.

6. Potential for Fraudulent Use

While check stub makers are legal, there is a possibility that some individuals may use them for fraudulent purposes. Using these tools to generate fake pay stubs for things like loan applications or mortgage approvals under false pretenses is illegal and could lead to serious consequences. Misrepresenting your income or financial situation can result in criminal charges, fines, and damage to your credit score.

It’s important to understand that while the tool itself is legal, the intention behind using it can affect its legality.

Conclusion

To answer the main question: Yes, check stubs makers are legal to use, as long as you use them for legitimate, accurate purposes. These tools offer a simple way to create professional pay stubs for both freelancers and small business owners. However, it’s essential to ensure that the information you enter is accurate and truthful to avoid legal trouble.

If you’re using a check stub maker for personal record-keeping or business purposes, make sure to:

- Provide accurate information

- Follow any relevant state or federal labor laws

- Use a secure, reputable service

By doing so, you can confidently use these tools to streamline your payroll process and stay compliant with financial regulations.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season