A Comprehensive Guide to Your Earnings Statement

- Uncategorized

eformscreator

eformscreator- October 16, 2024

- 16

Understanding your earnings statement is crucial for managing your finances effectively. Whether you’re an employee or a business owner, being able to read and interpret this document can help you track your income, understand deductions, and ensure you’re being paid correctly. This comprehensive guide will cover everything you need to know about your earnings statement, including what it is, why it’s important, and how to use a check stubs maker to create your own statements when necessary.

What Is an Earnings Statement?

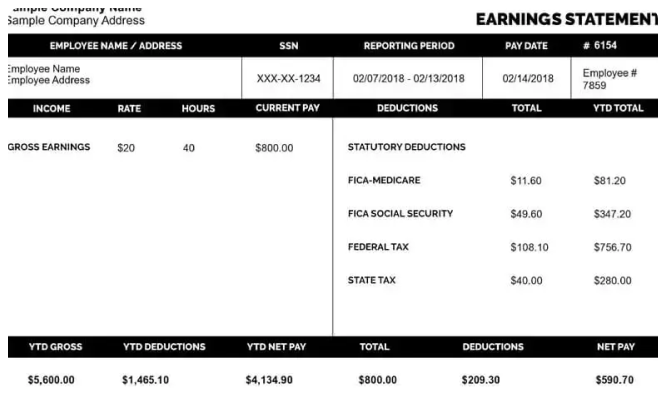

An earnings statement, also known as a paycheck stub or pay stub, is a document provided by your employer that outlines your earnings for a specific pay period. This statement details your gross pay, deductions, and net pay, helping you understand how much money you earned and what was taken out of your paycheck.

Key Components of an Earnings Statement

-

Employee Information: This section includes your name, employee ID, and sometimes your job title. It ensures that the statement corresponds to the correct individual.

-

Employer Information: Your employer’s name and address are also included. This information helps verify the source of your earnings.

-

Pay Period Dates: This indicates the start and end dates of the period for which you are being paid.

-

Gross Pay: This is the total amount you earned before any deductions. Gross pay can include your hourly wage, overtime, bonuses, and commissions.

-

Deductions: These are amounts taken out of your gross pay for taxes, insurance, retirement contributions, and other benefits. Common deductions include:

- Federal Income Tax: This is the tax withheld by the federal government based on your earnings and tax bracket.

- State Income Tax: Similar to federal tax, this is deducted according to your state’s tax laws.

- Social Security and Medicare Taxes: These are mandatory federal taxes that fund Social Security and Medicare programs.

- Health Insurance Premiums: If you have health insurance through your employer, your portion of the premium will be deducted from your pay.

- Retirement Contributions: If you participate in a retirement plan, such as a 401(k), these contributions will also be deducted.

-

Net Pay: This is the amount you take home after all deductions are made. It’s important to note this figure, as it reflects your actual earnings for that pay period.

-

Year-to-Date (YTD) Totals: This shows the total amounts for gross pay, deductions, and net pay from the beginning of the year to the current pay period. This is useful for budgeting and tax preparation.

Why Is Your Earnings Statement Important?

Your earnings statement serves several important functions:

-

Budgeting and Financial Planning: Understanding your income and expenses helps you create a budget that aligns with your financial goals. By reviewing your earnings statements regularly, you can adjust your spending habits and savings plans.

-

Tax Preparation: Your earnings statement contains vital information needed for filing taxes. The YTD totals help you estimate your taxable income and determine if you need to pay additional taxes or if you are owed a refund.

-

Verification of Payment: It’s essential to ensure that you are being paid accurately. If there are discrepancies, such as an incorrect gross pay amount or missing deductions, you can address these issues with your employer promptly.

-

Proof of Income: Many people need to provide proof of income for loans, rental applications, or government assistance programs. Your earnings statement can serve as official documentation of your income.

How to Read Your Earnings Statement

Reading your earnings statement may seem daunting at first, but it’s straightforward once you know what to look for. Here’s a step-by-step guide on how to read it:

-

Check Your Personal Information: Verify that your name and other details are correct. If there are any mistakes, notify your employer immediately.

-

Review the Pay Period: Ensure that the pay period dates match your work schedule. This helps confirm that you are being paid for the correct amount of time.

-

Look at Your Gross Pay: Make sure this amount aligns with your expected earnings. If you worked overtime or received a bonus, check that these amounts are included.

-

Examine the Deductions: Look closely at the deductions section. Ensure all deductions are accurate and reflect what you signed up for. If you notice any errors, speak to your payroll department.

-

Calculate Your Net Pay: Confirm that your net pay is correct by subtracting the total deductions from your gross pay. If it doesn’t add up, there might be an error.

-

Check the YTD Totals: Review the year-to-date totals to see how much you’ve earned and how much has been deducted for taxes and benefits throughout the year. This information is crucial for tax planning.

Common Mistakes to Avoid

While reading your earnings statement, be mindful of these common mistakes:

-

Ignoring Errors: If you spot an error, report it immediately. Delaying can complicate the resolution process.

-

Not Understanding Deductions: Make sure you understand all the deductions on your statement. If you’re unsure about any, reach out to your HR or payroll department for clarification.

-

Neglecting to Save Statements: Keep copies of your earnings statements for your records. They can be helpful for tax time or when applying for loans or apartments.

Using a Check Stubs Maker

If you’re self-employed or if you need to provide proof of income but don’t have traditional pay stubs, a check stubs maker can be a great tool. These online platforms allow you to create professional-looking pay stubs that accurately reflect your earnings and deductions.

Benefits of Using a Check Stubs Maker

-

Accuracy: Many check stubs makers calculate deductions for you based on current tax rates, ensuring your stubs are accurate.

-

Customization: You can input your personal information, earnings, and deductions, creating a stub that meets your specific needs.

-

Professional Appearance: A well-made check stub looks official, making it easier to present to banks, landlords, or any entity requiring proof of income.

-

Convenience: Creating a pay stub online is quick and easy. You can generate a stub at any time, without the need to visit an office or wait for paperwork.

How to Use a Check Stubs Maker

-

Choose a Reliable Service: Research and select a check stubs maker that has positive reviews and offers the features you need.

-

Input Your Information: Enter your personal details, including your name, address, and employer information. Then input your earnings, deductions, and pay period.

-

Review for Accuracy: Before finalizing, double-check all entered information to ensure everything is correct.

-

Generate the Stub: Once you’re satisfied, generate the pay stub. You can usually download it as a PDF for easy printing and sharing.

-

Keep Records: Save a copy of your generated pay stub for your records. This will be useful for future financial needs.

Conclusion

Understanding your earnings statement is an essential part of managing your finances. It not only helps you keep track of your income and deductions but also plays a crucial role in budgeting and tax preparation. By regularly reviewing your earnings statements and utilizing tools like a check stubs maker when necessary, you can take control of your financial future.

If you have any questions about your earnings statement or need assistance with creating a pay stub, don’t hesitate to reach out to your HR department or a financial advisor.