Top Features to Look for in a Check Stub Maker

In today’s digital age, managing finances has become more streamlined with the help of online tools. One such tool that can make your financial life much easier is a check stub maker. Whether you’re an employee, freelancer, or small business owner, using a check stub maker can simplify the process of generating accurate check stubs, which are vital for tracking earnings, taxes, and deductions.

But with so many check stub makers available on the market, how do you know which one is the best for you? In this blog, we will explore the top features you should look for in a check stub maker to ensure that you are choosing the right one for your needs. Whether you need to create check stubs for personal use, contractors, or employees, understanding these features will help you make an informed decision.

What is a Check Stub Maker?

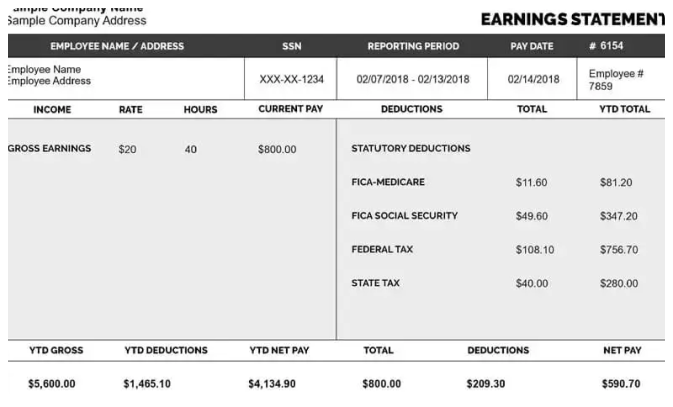

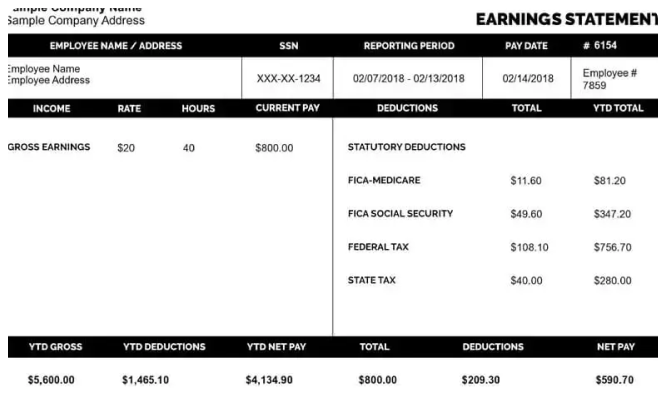

Before diving into the features, let’s first understand what a check stub maker is. A check stub maker is a tool, either software or an online service, that allows you to create detailed and professional check stubs quickly and easily. These stubs typically contain information such as the payee’s name, earnings, deductions, taxes, and net pay for each pay period. This tool can be used by both employees and employers, freelancers, and even small businesses who need to generate check stubs for their workers.

Now, let’s look at the features that make a great check stub maker.

1. Ease of Use

The first thing you should look for in a check stub maker is ease of use. You don’t want to waste time struggling with complicated software or tools that require extensive technical knowledge. The best check stub makers have a user-friendly interface that is simple to navigate.

Look for a platform that offers a step-by-step process where you can easily input all the necessary information, such as employee or contractor details, pay rates, deductions, and tax information. The more intuitive the design, the quicker you will be able to generate your check stubs without needing any technical expertise.

For example, a check stub maker should allow you to simply fill out fields like:

- Payee’s name

- Employer or business name

- Pay period

- Gross earnings

- Deductions (taxes, benefits, retirement contributions)

- Net pay

2. Customization Options

Different individuals and businesses may have specific needs when it comes to creating check stubs. Therefore, customization is a crucial feature to look for. A check stub maker that offers customizable templates can be a game-changer.

Whether you need to include specific deductions, benefits, or a company logo, the ability to customize your check stub templates will give your documents a professional look and ensure that all relevant information is captured. The best check stub makers allow you to add and remove fields, adjust the layout, and choose different designs.

For instance, if you’re a business owner, you may want to include detailed breakdowns of employee benefits like health insurance or retirement contributions. A customizable check stub maker will give you the flexibility to add these fields.

3. Accurate Tax Calculations

For employees, freelancers, or business owners who need to create check stubs for others, accurate tax calculations are non-negotiable. A check stub maker should automatically calculate federal, state, and local tax deductions based on the payee’s earnings and tax status.

The tool should allow you to input important tax-related information such as filing status, exemptions, and withholding allowances, and then calculate the appropriate deductions. Some check stub makers even update their tax tables regularly to reflect any changes in tax laws, ensuring your check stubs are always compliant.

If you’re running a small business and issuing paychecks to employees, having a tool that accurately calculates taxes will save you a lot of time and potential headaches. It will also ensure that your employees are getting the correct take-home pay.

4. Direct Deposit and Payment Information Integration

In addition to generating check stubs, integration with direct deposit and payment information can be an excellent feature for employers and business owners. Many check stub makers allow you to link your payment system with the tool, so that employees or contractors receive their pay via direct deposit. The check stub maker can automatically reflect these payments in the check stub, saving you the effort of manually tracking payments.

If you use an online payroll system or have a direct deposit set up for your employees, choosing a check stub maker with this integration can save both time and effort in managing payroll.

5. Security and Privacy

When dealing with financial documents, security and privacy should always be a top priority. Make sure the check stub maker you choose offers secure data encryption to protect sensitive information such as employee names, Social Security numbers, and bank account details.

Additionally, the platform should provide features like secure logins, password protection, and possibly two-factor authentication (2FA) to ensure that only authorized users have access to sensitive financial data.

When generating and storing check stubs, it’s important to know that your data is safe from potential breaches. Always choose a check stub maker that takes security seriously, especially if you’re using the tool for business purposes where compliance with regulations like the GDPR or HIPAA may be necessary.

6. Instant Access and Delivery

A good check stub maker should allow you to generate check stubs and download them instantly. Instant access to your check stubs is important, especially when you need to provide proof of income or resolve payroll issues quickly. A quick and easy download option allows you to store your check stubs digitally and access them anytime.

Many check stub makers also offer delivery services, allowing you to send check stubs directly to your employees via email or provide them with downloadable links. This can be particularly useful for remote teams or freelance workers who are not physically present to receive a paper check.

7. Mobile Accessibility

In today’s fast-paced world, being able to access and generate check stubs on the go is a major advantage. Many people now rely on smartphones and tablets to manage their finances, so mobile accessibility is an important feature to look for.

If you want to create or review your check stubs from anywhere, ensure the check stub maker you choose offers a mobile-friendly version or a dedicated app. This will allow you to stay on top of your finances even when you’re not at your desk.

8. Customer Support

A check stub maker should provide customer support in case you run into any issues or need assistance with using the platform. Good customer support can save you a lot of frustration, especially if you’re new to using check stub generators or have questions about tax deductions and calculations.

Look for a tool that offers multiple ways to contact support, such as email, phone, or live chat. A comprehensive FAQ section or a help center is also a bonus, as it can allow you to quickly find answers to common questions.

9. Affordability

While many check stub makers offer a range of features, it’s important to choose one that fits within your budget. Some check stub makers charge a flat monthly fee, while others offer pay-per-use models. Compare pricing options and see which one makes the most sense for your needs.

For individuals who only need to create a few check stubs a year, a pay-per-use model might be the best option. However, if you run a business and need to generate check stubs for multiple employees regularly, a monthly subscription may be more cost-effective in the long run.

10. Legal Compliance

Finally, ensure that the check stub maker you choose is compliant with all legal requirements. The check stubs should include all the necessary information to meet both federal and state laws, such as tax withholdings, deductions, and any mandatory benefit information.

Many check stub makers also offer customizable templates that are designed to comply with the legal standards in your state. Always verify that the tool you choose adheres to the current labor laws, especially if you’re a business owner issuing check stubs for employees.

Conclusion

A check stubs maker is a valuable tool that can save time and reduce errors when generating check stubs. Whether you’re an employee, freelancer, or small business owner, selecting the right check stub maker with the features that fit your needs is essential.

Look for a platform that offers ease of use, customization, accurate tax calculations, integration with direct deposit, and strong security measures. With these key features, you can ensure that your check stubs are accurate, professional, and compliant with legal standards.

Choosing the right check stub maker is an investment in your financial efficiency, and it can help you maintain organized records, avoid mistakes, and simplify your payroll and tax processes.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons