Check Stub Maker: An Essential Tool for Contractors and Gig Workers

- Business

eformscreator

eformscreator- November 15, 2024

- 2

In the modern workforce, contractors and gig workers play an essential role across various industries, from construction to freelancing. Whether you’re a contractor working on a long-term project or a gig worker handling multiple short-term tasks, keeping track of your income is crucial. One of the most effective ways to do this is by using a check stub maker. This simple tool can make managing your payments, taxes, and financial records more efficient. In this blog, we’ll explore why a check stub maker is a must-have for contractors and gig workers, and how it can help streamline your financial processes.

What is a Check Stub?

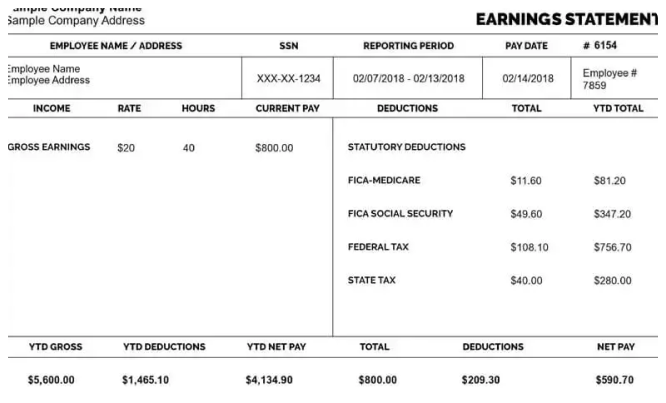

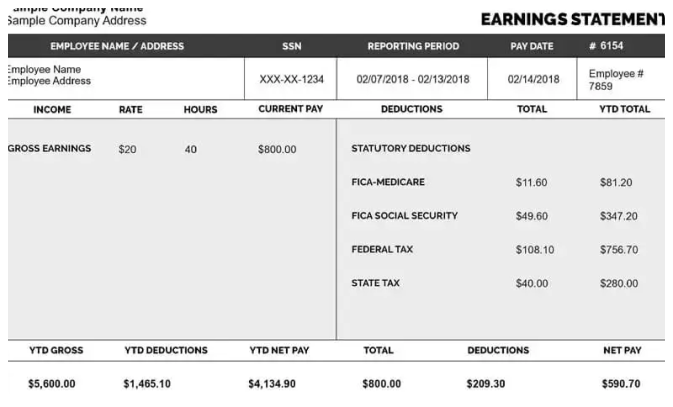

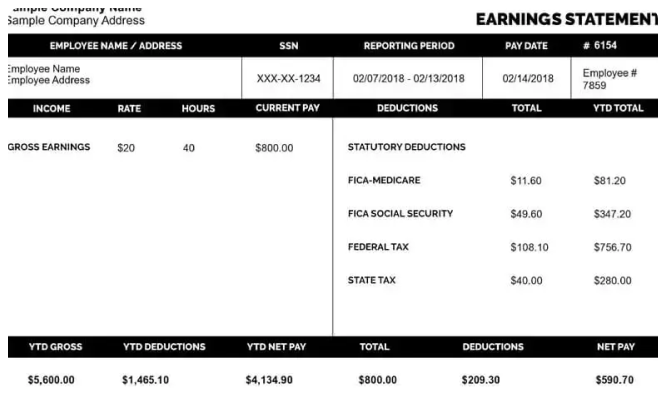

Before diving into the benefits of using a check stub maker, let’s first understand what a check stub is. A check stub is a document that shows the details of an employee’s payment. It typically includes information like:

- Gross pay (total earnings before deductions)

- Deductions (taxes, insurance, retirement contributions)

- Net pay (take-home pay after deductions)

- Employer information (company name and address)

- Pay period (dates for the work performed)

For contractors and gig workers, a check stub serves a similar purpose. It helps track earnings, deductions, and ensures that you have a detailed record of your payments. This is especially important when managing finances as an independent worker, as it can be more difficult to track income without a steady paycheck.

Why Contractors and Gig Workers Need a Check Stub Maker

Contractors and gig workers often face unique challenges when it comes to managing their finances. Unlike traditional employees who receive regular paychecks with built-in deductions, freelancers and contractors are usually responsible for tracking their own earnings, taxes, and benefits. Here’s why a check stub maker is an essential tool for these workers:

1. Accurate Record-Keeping

As a contractor or gig worker, you might be juggling multiple clients or projects at once. With a check stub maker, you can generate accurate records for each payment you receive. This helps you stay organized and ensures that you always know how much you’ve earned, how much has been deducted, and what your net pay is. Having these records on hand makes it easier to track your income over time, which is essential for budgeting and tax preparation.

2. Easy Tax Filing

One of the biggest concerns for independent workers is taxes. Since contractors and gig workers are typically considered self-employed, they are responsible for paying their own taxes, including income tax and self-employment tax. Without a check stub to show the total amount of earnings, deductions, and taxes owed, it can be difficult to calculate exactly how much you need to pay.

A check stub maker helps by breaking down your pay and deductions, making tax time easier. With detailed records of your income, you can more accurately report your earnings on your tax return. Plus, if you’re ever audited, you’ll have proof of the payments you’ve received and how much you’ve paid in taxes.

3. Professional Image

For contractors and gig workers, maintaining a professional image is key to attracting and retaining clients. A check stub not only helps you keep track of your earnings, but it also demonstrates to your clients that you are serious about your work. Providing clients with a well-organized check stub can be an added bonus when it comes to getting paid on time. It shows that you are transparent, professional, and organized.

4. Easier Budgeting

Knowing exactly how much money you’re earning and where it’s going is essential when you’re managing your own finances. A check stub maker gives you a breakdown of your income, including all the deductions, which helps you set realistic financial goals and budgets. Whether you’re saving for a large purchase, paying down debt, or planning for retirement, having a clear picture of your income and expenses will help you stay on track.

5. Tracking Deductions and Benefits

Unlike full-time employees, contractors and gig workers typically don’t have benefits automatically deducted from their paychecks, such as health insurance, retirement plans, or other benefits. However, you might still have personal deductions that you’re paying, such as health insurance premiums or retirement contributions.

A check stub can help you track these deductions to ensure you’re staying on top of them. By using a check stub maker, you can keep a record of how much you’re contributing to these expenses, which helps you maintain financial responsibility and make informed decisions about your benefits.

6. Managing Multiple Clients or Jobs

Many contractors and gig workers work with multiple clients or hold several jobs simultaneously. Tracking payments and ensuring you’re paid accurately can become overwhelming without a proper system in place. A check stub maker allows you to generate detailed records for each client or job, so you can track income from different sources and ensure you’re paid correctly.

Whether you’re working on a construction project, providing freelance writing services, or driving for a rideshare company, a check stub maker can simplify the process of keeping track of all your income streams.

How to Use a Check Stub Maker

Using a check stub maker is easy and straightforward. Many online tools are available that allow contractors and gig workers to generate professional-looking check stubs. Here’s a quick guide on how to use a check stub maker:

-

Enter Your Information: You’ll need to input your personal information, such as your name, address, and tax information. You’ll also need to add your client’s or employer’s details.

-

Input Payment Information: Next, input the details of your payment, including the total amount earned, the pay period, and any deductions or taxes that should be applied.

-

Review and Customize: Most check stub makers allow you to review and customize your check stub. You can choose from different templates and designs to make your stub look professional.

-

Generate and Save: Once you’re satisfied with your check stub, you can generate it and save it as a PDF or print it out for your records.

-

Share with Clients: If necessary, you can send the check stub to your clients to keep them informed about the payments you’ve received.

Conclusion

For contractors and gig workers, managing income and taxes can seem daunting, but a check stub maker can make the process much easier. With accurate records of your payments, deductions, and taxes, you can stay organized, reduce the risk of mistakes, and save time during tax season. Whether you’re a freelancer, a contractor, or a gig worker, using a check stub maker is a smart decision that can help you take control of your finances and project a professional image to your clients.