What Are the Best Features of a Mutual Fund Software in India?

In today’s fast-evolving financial world, Mutual Fund Distributors (MFDs) realize that they need technology to stay ahead. They know that adopting software is the way forward. However, many MFDs are unsure about which features they should prioritize when choosing the best mutual fund software in India. With numerous options available, understanding the key features becomes critical to ensuring smooth operations and client satisfaction.

Challenges Faced by MFDs

MFDs face several operational and management challenges in their day-to-day activities. These include:

1. Excessive Paperwork

Handling client documentation, transaction forms, and investment details manually can be time-consuming. It adds to the workload and increases the chance of human errors.

2. Frequent Redemptions

Frequent redemptions by clients impact the distributor’s Assets Under Management (AUM), leading to reduced revenue. Managing redemptions manually also makes it harder to strategize and retain clients.

3. Client Engagement

Keeping clients informed and engaged through regular communication can be difficult, especially when done manually. MFDs struggle to keep track of their clients’ portfolios and address their concerns on time.

4. Complex Asset Management

Managing multiple asset classes, such as mutual funds, stocks, bonds, and insurance, across different platforms can be overwhelming. It leads to inefficiencies and limits the MFD’s ability to offer holistic financial solutions.

5. Regulatory Compliance

Staying updated with regulatory requirements and generating compliance reports manually adds pressure on MFDs, leaving them less time for other critical business activities.

How Can the Right Technology Help?

To resolve these challenges, MFDs need the top mutual fund software in India. With feature-rich portfolio management software, MFDs can:

- Automate transactions like purchases, redemptions, and SIPs.

- Enhance client engagement through better reporting and real-time updates.

- Manage multiple assets under one platform for ease of access.

- Ensure regulatory compliance with automated reports and data handling.

- Reduce paperwork and manual processes, freeing up time for strategic business activities.

Best Features to Look for in Software

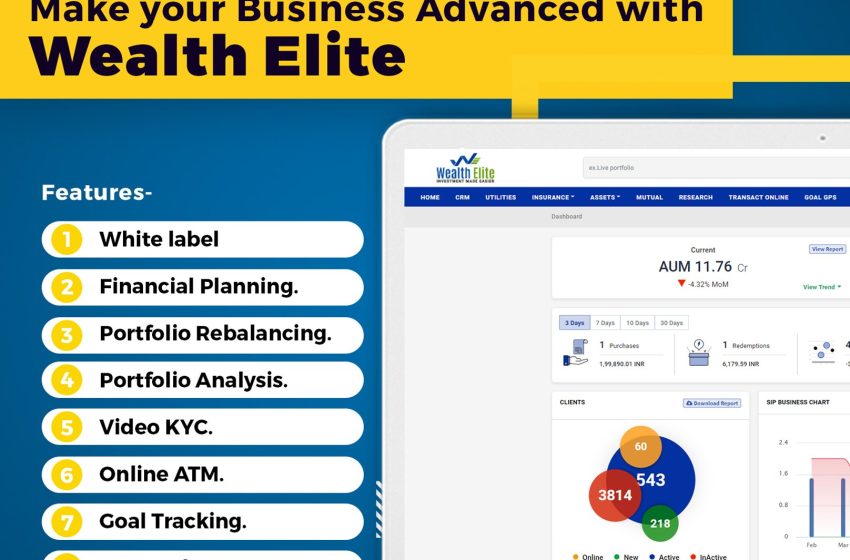

Here are some of the essential features that make your wealth management software stand out in India:

1. Goal-Based Financial Planning

Clients today want more than just mutual fund advice. They are looking for holistic financial plans that align with their life goals. Goal-based planning tools in the software help MFDs build customized financial plans for their clients based on specific goals such as retirement, children’s education, or home buying. This feature improves client retention and satisfaction as it provides a personalized approach to financial planning.

2. Risk Profiling Tools

Risk profiling is critical to determining a client’s risk tolerance and investment suitability. The best software offers built-in risk profiling tools that assess the risk appetite of clients. This ensures that investment recommendations are aligned with the client’s risk preferences, minimizing mismatches and enhancing client trust.

3. Online Transactions

Online transactions across platforms like NSE, BSE, and MFU allow MFDs to process transactions such as purchases, redemptions, and SIP/STP/SWP seamlessly. This feature eliminates the need for paperwork and manual processing, which speeds up transaction times and reduces errors.

4. Digital Onboarding

A powerful digital onboarding feature allows MFDs to onboard clients swiftly without the hassle of physical documentation. KYC processes can be completed digitally, which reduces onboarding time and enhances the client experience. This feature is particularly important in today’s digital-first era, where clients expect quick and efficient services.

5. Multi-Asset Investment Management

Managing multiple assets under one platform is a must for modern MFDs. The best software integrates investments from various asset classes such as Real estate, bonds, insurance, and commodities. This consolidated view enables MFDs to offer holistic financial solutions and manage their clients’ entire portfolios efficiently.

6. Portfolio Rebalancing

Market fluctuations and changes in client goals require constant monitoring and portfolio adjustments. A portfolio rebalancing feature allows MFDs to ensure that the client’s asset allocation remains in line with their financial objectives. This keeps investments optimized and mitigates unnecessary risks.

7. Automated Client Reporting

Keeping clients updated on their investments is crucial. Software that provides automated client reporting offers MFDs the ability to send performance reports and portfolio updates regularly without manual effort. This enhances communication and ensures clients remain informed and engaged.

8. Regulatory Compliance Tools

Ensuring compliance with SEBI and other regulatory bodies can be a complex task for MFDs. The best software provides automated compliance tools that generate necessary reports, track regulations, and ensure MFDs remain compliant without the hassle of manual intervention.

9. Research and Calculators

Research tools and calculators, such as SIP calculators, fund comparison tools, and market analysis, are invaluable for MFDs. These tools help distributors make informed investment decisions and provide clients with data-driven advice.

Conclusion

A feature-rich software solution helps MFDs automate tasks, improve client relationships, and manage multiple assets seamlessly. By reducing manual work and enhancing client engagement, MFDs can focus more on revenue-generating activities, driving business growth and improving their overall efficiency.