Paystub Creator Reviews: Our Top Picks for 2024

- Business

eformscreator

eformscreator- September 30, 2024

- 9

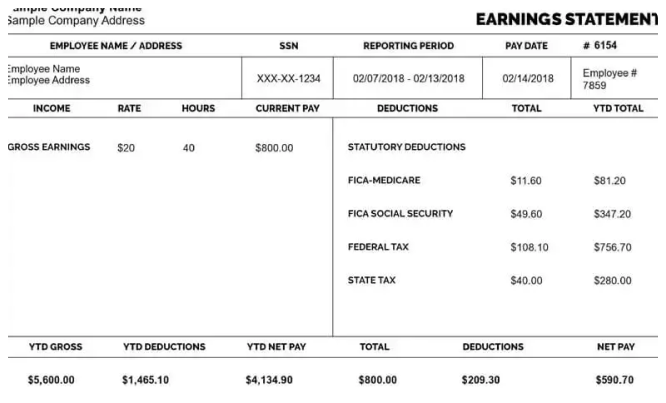

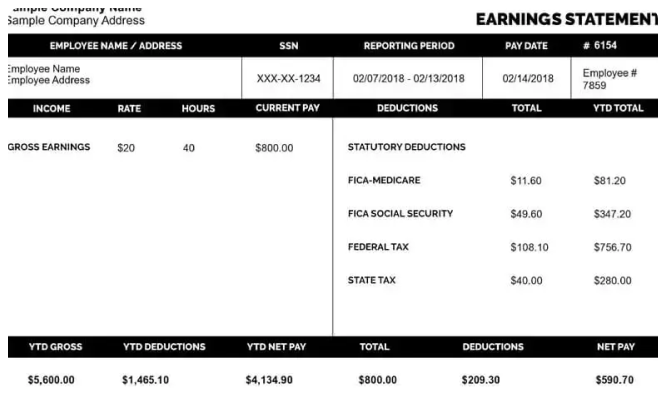

When running a business or managing payroll, creating paystubs can be a daunting task. Paystubs are essential for tracking employee wages, taxes, and benefits, but not everyone has the time or resources to create them from scratch. That’s where paystub creators come in. In this blog, we’ll explore the best paystub creator of 2024, highlighting their features, pros, cons, and everything else you need to know. Whether you’re a small business owner, a freelancer, or an employee who needs paystubs for a loan application, we’ve got you covered.

What Is a Paystub Creator?

A paystub creator is an online tool or software that allows you to generate paystubs quickly and easily. These tools often include pre-made templates where you can input your company’s information, employee details, and payment amounts. Some paystub creators also allow you to customize the design, add your logo, and even save or print the paystubs for your records.

Using a paystub creator can save you time and ensure accuracy, making it a great option for business owners and HR departments.

Why Use a Paystub Creator?

-

Time-Saving: Manually creating paystubs can be time-consuming. A paystub creator automates much of the process, allowing you to generate paystubs in just a few minutes.

-

Accuracy: Calculating wages, taxes, and deductions can be tricky. Paystub creators often have built-in calculators that minimize errors, ensuring you comply with tax laws.

-

Professional Appearance: Paystubs created through these tools look professional, giving your employees and clients confidence in your business.

-

Customization: Many paystub creators offer customizable templates, allowing you to include your company logo and choose your colors, making your paystubs unique.

-

Accessibility: Most paystub creators are online, which means you can access them from anywhere, anytime, using a computer or smartphone.

Top Paystub Creators of 2024

Here are our top picks for paystub creators in 2024, each with its unique features and benefits.

1. Stubbuilder

Overview: Stubbuilder is one of the most user-friendly options available. It allows you to create paystubs in just a few simple steps.

Features:

- Easy-to-use interface

- Customizable templates

- Ability to calculate deductions automatically

- Instant downloads

Pros:

- No software installation required

- Affordable pricing plans

- Excellent customer support

Cons:

- Limited advanced features for larger businesses

Ideal For: Small businesses and freelancers who need quick and easy paystub generation.

2. The Paystubs Generator

Overview: The Paystubs Generator offers a comprehensive solution for paystub creation, with a focus on compliance and accuracy.

Features:

- Extensive library of paystub templates

- Option to add overtime, bonuses, and other variables

- IRS-compliant calculations

- Multi-state tax calculations

Pros:

- Very detailed reports

- Fast processing times

- Mobile-friendly interface

Cons:

- Slightly higher price point than some competitors

Ideal For: Businesses operating in multiple states or those with complex payroll needs.

3. Paystub Creator

Overview: Paystub Creator provides a range of payroll tools, including a robust paystub creator.

Features:

- User-friendly online calculator

- Multiple paystub formats

- Tax rate updates for all states

- Integration with other payroll services

Pros:

- Highly accurate tax calculations

- Great for seasonal businesses

- Educational resources available

Cons:

- Some users report a learning curve for new features

Ideal For: Businesses looking for a full-service payroll solution alongside paystub creation.

4. SmartPaystub

Overview: SmartPaystub is designed for quick, hassle-free paystub generation without the need for complex accounting knowledge.

Features:

- Simple input fields

- Automatic tax deduction calculations

- Paystub preview before downloading

- 24/7 customer support

Pros:

- Very easy to navigate

- Affordable pricing options

- Provides email delivery for paystubs

Cons:

- Limited customization options compared to others

Ideal For: Individuals or small business owners who want a straightforward, no-fuss solution.

5. WageTool

Overview: WageTool offers a slightly different approach by focusing on both paystub creation and payroll management.

Features:

- Paystub generation and payroll tracking

- Export options for accounting software

- Custom deductions and contributions

- Employee self-service portal

Pros:

- Combines paystub and payroll functionalities

- Great for larger businesses

- Strong security measures

Cons:

- More complex than basic paystub creators

Ideal For: Medium to large businesses that require an integrated payroll system.

How to Choose the Right Paystub Creator

Choosing the right paystub creator depends on several factors, including your specific needs, budget, and the size of your business. Here are some tips to help you make the right choice:

1. Assess Your Needs

Consider what features are essential for your business. Do you need basic paystub generation, or do you require more advanced functionalities like tax calculations and payroll management?

2. Budget

Look at your budget and find a paystub creator that fits within your price range. Some options offer pay-per-use plans, while others have monthly subscriptions.

3. Ease of Use

Choose a tool that is easy to navigate, especially if you’re not tech-savvy. A user-friendly interface can save you time and frustration.

4. Customer Support

Good customer support is vital, especially if you encounter any issues. Look for providers that offer 24/7 support or at least comprehensive FAQs and resources.

5. Reviews and Recommendations

Check online reviews and ask other business owners for their recommendations. Real user experiences can provide valuable insights.

Conclusion

In 2024, having a reliable paystub creator can make a world of difference for businesses and employees alike. Whether you’re a small business owner looking to streamline payroll or an employee needing professional paystubs for personal reasons, the right tool can save you time and ensure accuracy.

From our top picks, there’s a paystub creator to suit every need, whether it’s ease of use, customization options, or advanced features. As you explore these options, consider your specific requirements and choose a tool that fits your budget and workflow.