Accurate Earnings in Florida: Using a Paystub Creator and Paycheck Calculator

Understanding your earnings is crucial, especially when living and working in a state like Florida, where personal financial management can have significant implications on your quality of life. Whether you’re a small business owner managing payroll for your employees, a freelancer tracking your income, or a salaried employee ensuring your paycheck is accurate, tools like a paystub creator and a Florida paycheck calculator are invaluable. This blog will guide you through how to use these tools effectively, ensuring you maintain accurate earnings records.

The Importance of Accurate Earnings

Accurate earnings records are essential for several reasons. They help you track your income, prepare for taxes, and provide proof of income when applying for loans, renting apartments, or making significant purchases. For business owners, accurate earnings records ensure that employees are paid correctly, fostering trust and reducing potential disputes. Inaccurate records, on the other hand, can lead to financial discrepancies, tax issues, and other complications that could disrupt your financial stability.

Florida’s Unique Payroll Landscape

Florida has its own unique payroll landscape. Unlike many other states, Florida does not impose a state income tax. While this is beneficial for residents in terms of take-home pay, it also means that individuals and businesses must be diligent in ensuring other payroll components are accurately calculated. This includes Social Security, Medicare, and federal income taxes, along with any voluntary deductions like retirement contributions or health insurance premiums.

Given these complexities, using a Florida paycheck calculator becomes essential. This tool can help you estimate your take-home pay after all federal taxes and deductions, ensuring you know exactly what to expect in your paycheck. For business owners, a paycheck calculator Florida can simplify payroll processes, helping to ensure that all calculations are accurate and compliant with federal regulations.

What is a Paystub Creator?

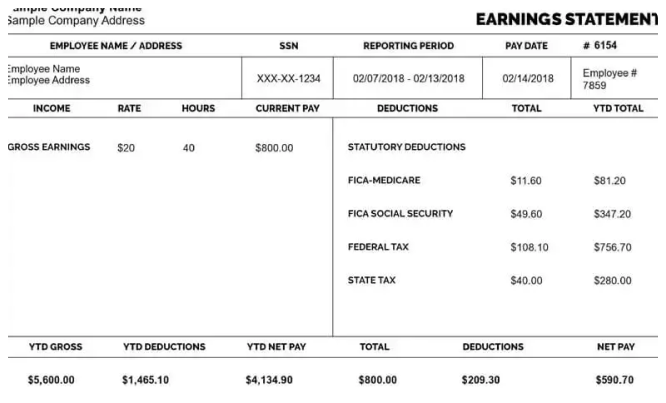

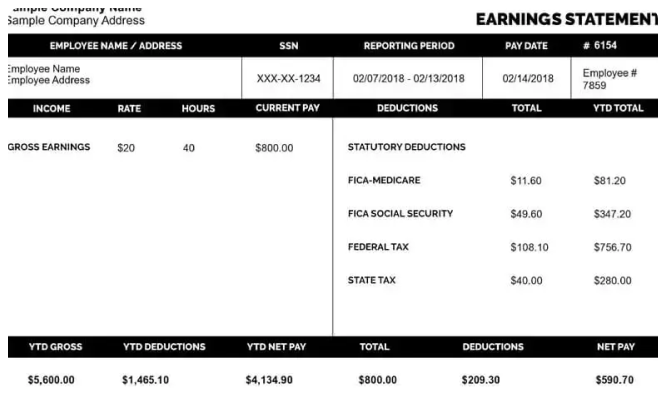

A paystub creator is a tool that allows you to generate paystubs for yourself or your employees. These documents provide a detailed breakdown of your earnings, taxes, deductions, and net pay. For employees, a paystub serves as proof of income and helps them understand how their earnings are calculated. For employers, it ensures transparency and accuracy in payroll management.

Benefits of Using a Paystub Creator

-

Accuracy: A paystub creator reduces the risk of errors in your payroll records. It automatically calculates taxes, deductions, and net pay based on the information you provide, ensuring that every paystub is accurate.

-

Professionalism: Using a paystub creator ensures that your paystubs are professional and easy to read. This is particularly important if you’re a small business owner or freelancer, as it helps you present a professional image to clients, lenders, and other parties.

-

Compliance: Paystub creators are designed to comply with federal regulations, ensuring that all necessary information is included in each paystub. This can help you avoid potential legal issues related to payroll discrepancies.

-

Convenience: With a paystub creator, you can generate paystubs quickly and easily, without the need for complex software or extensive payroll knowledge. This makes it a convenient option for small business owners, freelancers, and anyone who needs to manage payroll on their own.

How to Use a Paystub Creator

Using a paystub creator is typically straightforward. Here’s a step-by-step guide:

-

Enter Your Information: Input your personal or business details, including your name, address, and Social Security number or employer identification number (EIN).

-

Input Earnings Information: Enter your gross earnings for the pay period. This could be your hourly wage multiplied by the number of hours worked, or a set salary amount.

-

Add Deductions: Input any deductions, such as federal taxes, Social Security, Medicare, and any voluntary deductions like retirement contributions or health insurance premiums.

-

Generate the Paystub: Once all information is entered, the paystub creator will calculate your net pay and generate a professional paystub that you can save, print, or send electronically.

The Role of a Florida Paycheck Calculator

A Florida paycheck calculator is a tool designed to help you estimate your take-home pay based on your gross income, federal taxes, and any additional deductions. Since Florida does not have a state income tax, a Florida paycheck calculator focuses on federal taxes, Social Security, Medicare, and any other deductions that apply.

Why You Need a Florida Paycheck Calculator

-

Estimate Your Take-Home Pay: Knowing how much you’ll take home after taxes and deductions is crucial for budgeting and financial planning. A paycheck calculator Florida helps you get an accurate estimate, so you’re never caught off guard by your paycheck.

-

Plan for Deductions: If you have multiple deductions, such as retirement contributions or health insurance premiums, a paycheck calculator can help you see how these deductions impact your take-home pay. This can be particularly useful when deciding how much to contribute to retirement accounts or other voluntary deductions.

-

Avoid Surprises: Using a Florida paycheck calculator can help you avoid surprises when you receive your paycheck. By knowing exactly how much will be deducted for taxes and other expenses, you can plan your finances more effectively.

-

Business Payroll Management: For small business owners, a Florida paycheck calculator simplifies payroll management. It helps you calculate employee paychecks accurately, ensuring that all federal taxes and deductions are accounted for.

How to Use a Florida Paycheck Calculator

Using a Florida paycheck calculator is simple:

-

Input Your Gross Income: Start by entering your gross income for the pay period. This is your total earnings before any taxes or deductions are applied.

-

Enter Deductions: Input any deductions that apply, including federal taxes, Social Security, Medicare, and any voluntary deductions like retirement contributions or health insurance.

-

Calculate: Once all information is entered, the paycheck calculator will estimate your take-home pay, showing you the exact amount you can expect to receive.

-

Review and Adjust: Review the results and make any necessary adjustments to your deductions or withholding to better match your financial goals.

Using Free Paystub Generators

If you’re looking for a cost-effective way to generate paystubs, a free paystub generator can be a great option. These tools offer many of the same benefits as paid versions, including accuracy, professionalism, and compliance. They’re particularly useful for freelancers, small business owners, and anyone who needs to create paystubs on a budget.

Finding a Reliable Free Paystub Generator

When choosing a free paystub generator, it’s essential to ensure that the tool you select is reliable and secure. Look for generators that are easy to use, offer customization options, and provide a professional, polished final product. It’s also important to ensure that the generator complies with federal regulations and includes all necessary information on each paystub.

Advantages of Free Paystub Generators

-

Cost-Effective: As the name suggests, a free paystub generator doesn’t cost anything to use, making it an excellent option for those on a tight budget.

-

User-Friendly: Most free paystub generators are designed to be easy to use, even if you have little to no experience with payroll.

-

Professional Results: Despite being free, many of these tools offer high-quality, professional paystubs that you can use for a variety of purposes.

Limitations of Free Paystub Generators

While free paystub generators are a great option for many people, they do have some limitations:

-

Limited Features: Free paystub generators may not offer as many features or customization options as paid versions.

-

Ads or Branding: Some free tools may include ads or branding on the final paystub, which may not be ideal for professional use.

-

Security Concerns: It’s essential to ensure that any free tool you use is secure, especially when entering sensitive information like Social Security numbers.

Conclusion

Accurate earnings management is crucial for anyone working in Florida, whether you’re an employee, freelancer, or business owner. By using tools like a paystub creator and a Florida paycheck calculator, you can ensure that your earnings are accurately tracked and reported. These tools help you plan your finances, avoid surprises, and maintain compliance with federal regulations. For those on a budget, a free paystub generator offers a cost-effective way to generate professional paystubs, although it’s important to choose a reliable and secure option.