Gig Economy and Taxes: Navigating Paystubs and Tax Filings for Freelancers

- Business

eformscreator

eformscreator- August 28, 2024

- 14

The gig economy is booming, with more people than ever embracing freelance work as a primary or supplementary source of income. While the flexibility and independence of freelancing are attractive, they also come with unique challenges, especially when it comes to managing finances and taxes. Unlike traditional employees, freelancers must navigate complex tax regulations, create their own paystubs, and ensure accurate tax filings. In this blog, we’ll explore the essentials of managing paystubs and tax filings as a freelancer and how tools like a pay stub generator free can simplify the process.

Understanding the Gig Economy

The gig economy refers to a labor market characterized by short-term contracts or freelance work as opposed to permanent jobs. Freelancers, independent contractors, and gig workers often juggle multiple clients or projects simultaneously. While this model offers flexibility, it also means that freelancers are responsible for their own financial management, including tax filings, which can be more complicated than those of traditional employees.

Why Paystubs Matter for Freelancers

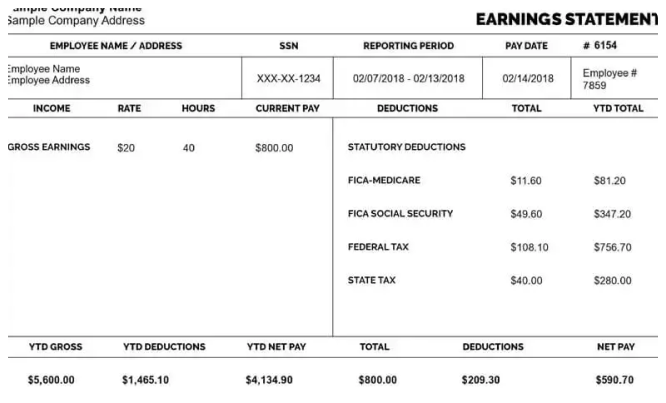

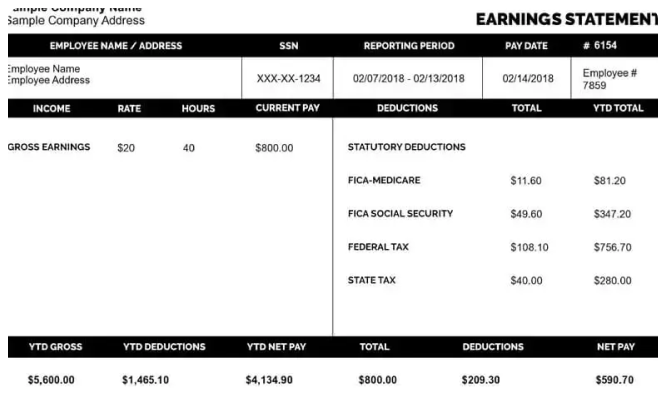

Unlike traditional employees who receive regular paychecks with attached paystubs from their employers, freelancers must generate their own paystubs. Paystubs are essential for tracking income, managing finances, and providing proof of earnings for various purposes, such as applying for loans, renting an apartment, or even filing taxes.

1. Income Tracking

Freelancers often work for multiple clients, each with different payment schedules. Without regular paystubs, it can be challenging to track income accurately. A paystub provides a detailed record of each payment, including the amount earned, taxes withheld, and any deductions.

2. Financial Planning

Effective financial planning requires a clear understanding of income and expenses. By generating paystubs, freelancers can monitor their earnings over time, helping them budget for both personal and business expenses. Paystubs also provide a snapshot of income trends, which can be useful for making informed financial decisions.

3. Proof of Income

Freelancers often need to provide proof of income for various purposes, such as applying for credit, securing a mortgage, or leasing an apartment. Paystubs serve as a formal document that verifies income, making it easier to meet these requirements.

Navigating Taxes as a Freelancer

One of the most significant challenges for freelancers is managing taxes. Unlike traditional employees, freelancers do not have taxes automatically withheld from their paychecks. Instead, they are responsible for calculating and paying their own taxes, including self-employment tax, federal income tax, and, in some cases, state and local taxes.

1. Self-Employment Tax

Self-employment tax is a combination of Social Security and Medicare taxes, which are typically withheld from a traditional employee’s paycheck. Freelancers must pay the full 15.3% self-employment tax on their net earnings, as they do not have an employer to cover half of this tax.

Using a Pay Stub Generator Free: A pay stub generator free can help freelancers calculate their self-employment tax and reflect it on their paystub. This tool ensures that freelancers are aware of the taxes they owe and can set aside the necessary funds.

2. Quarterly Tax Payments

Freelancers are required to make estimated tax payments on a quarterly basis. These payments cover federal income tax, self-employment tax, and any applicable state and local taxes. Failing to make these payments on time can result in penalties and interest charges.

Using a Pay Stub Generator Free: By generating regular paystubs using a pay stub generator free, freelancers can track their income and calculate their estimated taxes more accurately. This helps ensure that they set aside enough money for quarterly tax payments and avoid surprises at tax time.

3. Deductions and Expenses

Freelancers are eligible for various tax deductions, including business expenses such as office supplies, travel, and software. These deductions can significantly reduce taxable income, but they must be well-documented.

Using a Pay Stub Generator Free: A pay stub generator can help freelancers itemize their business expenses and deductions on their paystubs. By keeping detailed records, freelancers can maximize their deductions and reduce their overall tax liability.

Creating Paystubs as a Freelancer

Creating paystubs as a freelancer may seem like an unnecessary task, but it’s an essential part of managing finances and ensuring accurate tax filings. Fortunately, tools like a pay stub generator free make this process simple and efficient.

1. Accuracy

A pay stub generator allows freelancers to input their earnings, expenses, and taxes, automatically calculating the net income. This ensures that paystubs are accurate and reflect the true financial picture.

2. Consistency

By using a pay stub generator regularly, freelancers can maintain consistent financial records. This consistency is crucial for tracking income, preparing for tax filings, and providing proof of earnings.

3. Customization

Freelancers often have unique income streams and expenses. A pay stub generator allows for customization, enabling freelancers to tailor their paystubs to reflect their specific financial situation. This includes adding business deductions, self-employment tax, and other relevant details.

4. Ease of Use

One of the main advantages of using a pay stub generator free is its ease of use. These tools are designed to be user-friendly, with intuitive interfaces that guide freelancers through the process of creating accurate and professional paystubs in minutes.

Tax Filing Tips for Freelancers

When tax season arrives, freelancers need to be well-prepared to file their taxes accurately. Here are some tips to help make the process smoother:

1. Keep Detailed Records

Freelancers should keep detailed records of all income and expenses throughout the year. Paystubs generated using a pay stub generator free can serve as part of these records, providing a clear summary of earnings and deductions.

2. Understand Tax Deductions

Freelancers should familiarize themselves with the tax deductions available to them. This includes business expenses, home office deductions, and any other relevant deductions that can reduce taxable income.

3. Use Tax Software

Tax software can simplify the tax filing process for freelancers. Many tax software programs are designed specifically for self-employed individuals, guiding them through the process of calculating self-employment tax, applying deductions, and filing returns.

4. Consult a Tax Professional

For freelancers with complex tax situations, consulting a tax professional can be a wise investment. A tax professional can provide personalized advice, help maximize deductions, and ensure that tax filings are accurate and compliant with IRS regulations.

Conclusion

Navigating paystubs and tax filings as a freelancer can be challenging, but with the right tools and knowledge, it’s entirely manageable. Paystubs are a vital part of financial management for freelancers, providing a clear record of income, expenses, and taxes. By using a pay stub generator free, freelancers can easily create accurate and professional paystubs, helping them track their earnings, plan for taxes, and provide proof of income when needed.