How to Get Your W-2 from Texas Roadhouse

Obtaining your W-2 from Texas Roadhouse is a crucial step for managing your tax filings and ensuring accurate income reporting. If you’re a current or former employee, understanding how to access your W-2 efficiently can save you time and ensure that your tax returns are filed correctly. In this blog, we will walk you through the steps to get your W-2 from Texas Roadhouse and discuss how a free paystub generator can be useful in managing your income documentation.

What is a W-2?

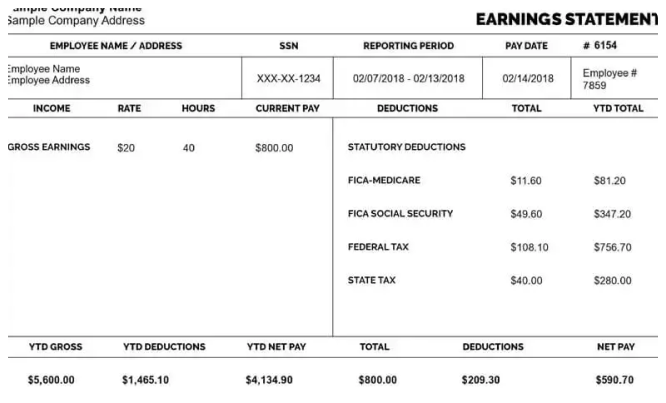

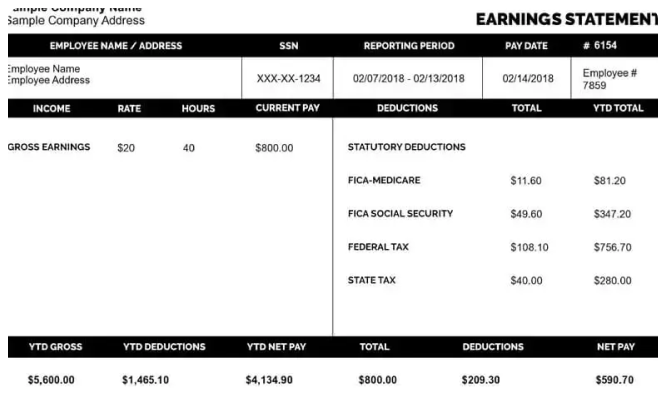

A W-2 form is an official document provided by your employer that reports your annual earnings and the amount of taxes withheld. It includes:

- Employee Information: Your name, address, and Social Security number.

- Employer Information: Texas Roadhouse’s name, address, and Employer Identification Number (EIN).

- Earnings Details: Total wages, tips, and other compensation.

- Tax Withholdings: Federal income tax withheld, Social Security tax, and Medicare tax.

The W-2 is essential for filing your federal and state tax returns and for verifying your income for financial applications.

Steps to Obtain Your W-2 from Texas Roadhouse

1. Check Your Mail

Texas Roadhouse typically sends out W-2 forms to employees via postal mail. If you’re a current employee, your W-2 should be sent to your last known address. Former employees will receive their W-2 at the address they had on file when they left the company.

- Verify Address: Ensure that Texas Roadhouse has your correct mailing address to avoid delays.

- Expected Mailing Period: W-2 forms are generally sent out by the end of January each year. Check your mail for delivery around this time.

2. Log Into the Employee Portal

If Texas Roadhouse offers an online employee portal, you may be able to access your W-2 electronically:

- Access Portal: Visit the Texas Roadhouse employee portal website. If you don’t have the link, contact HR or your supervisor for guidance.

- Login: Enter your login credentials. If you’re a new user, you may need to create an account.

- Download W-2: Navigate to the section for tax documents or W-2 forms. You should be able to view and download your W-2 directly from the portal.

3. Contact Texas Roadhouse HR

If you have not received your W-2 or cannot access it online, contacting Texas Roadhouse’s HR department is a good option:

- Request a Copy: Reach out to HR via phone or email. Provide your name, employee ID (if available), and your current address to request a copy of your W-2.

- Follow Up: If there are delays or issues, follow up with HR to ensure that your request is being processed.

4. Update Your Address

If you’ve moved recently or changed your address, make sure that Texas Roadhouse has your updated information:

- Submit Address Change: Contact HR to update your address and ensure that your W-2 is sent to the correct location.

- Check Address on Portal: If available, verify your address through the employee portal to confirm that it is up to date.

Using a Free Paystub Generator

While a W-2 provides a comprehensive summary of your annual earnings and taxes, you might need additional documentation for various purposes. A free paystub generator can help you create detailed pay stubs for your records. Here’s how it can be useful:

1. Create Pay Stubs for Record-Keeping

A free paystub generator allows you to create pay stubs for each pay period:

- Input Details: Enter details such as your name, employer’s name, earnings, and deductions. The generator will format this information into a professional pay stub.

- Track Earnings: Use pay stubs to keep track of your earnings throughout the year, which can help you compare with your W-2 for accuracy.

2. Provide Proof of Income

If you need to provide proof of income for loans, rental applications, or other purposes, a free paystub generator can help:

- Generate Proof of Income: Create pay stubs that reflect your earnings. This can be useful if you need to demonstrate your financial situation before receiving your W-2.

3. Verify Accuracy

Using a paystub generator can help you verify that the information on your W-2 is correct:

- Compare Pay Stubs and W-2: Ensure that the total earnings and tax withholdings on your W-2 match the information on your pay stubs. This can help identify any discrepancies.

Troubleshooting Common Issues

If you encounter problems with obtaining your W-2 or using a paystub generator, consider these troubleshooting tips:

1. Missing W-2

If your W-2 is missing or hasn’t arrived:

- Contact HR: Reach out to Texas Roadhouse’s HR department to request a replacement.

- Check Online: Ensure that you’ve checked the employee portal and your mail thoroughly.

2. Incorrect Information

If you notice incorrect information on your W-2 or pay stub:

- Notify HR: Report any discrepancies to Texas Roadhouse’s HR department. They can issue a corrected W-2 if necessary.

- Update Records: Make sure all personal and employment information is up to date with HR.

3. Using Paystub Generators

If you face issues with a free paystub generator:

- Verify Source: Ensure you’re using a reputable and reliable paystub generator.

- Check Accuracy: Double-check the accuracy of the information you input into the generator.

Conclusion

Obtaining your W-2 from Texas Roadhouse involves checking your mail, accessing the employee portal, or contacting HR for assistance. If you need additional documentation, a free paystub generator can be a valuable tool for creating detailed pay stubs and managing your income records.

Always ensure that you use accurate and honest information when dealing with financial documentation. If you encounter any issues, follow the appropriate steps to resolve them and maintain accurate records for tax filing and financial management. By staying organized and proactive, you can ensure a smooth process for obtaining and using your W-2 and other financial documents.

Read Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a McDonald’s Pay Stubs?