Decoding Paystub Codes and Abbreviations: A Comprehensive Guide

- Finance

eformscreator

eformscreator- July 24, 2024

- 24

Understanding your paystub is crucial for accurate financial management, budgeting, and tax planning. However, paystubs often include a variety of codes and abbreviations that can be confusing. This guide will help you decode these terms and provide insights into how tools like a paystub generator can assist in managing your pay information effectively.

Common Paystub Codes and Abbreviations

Paystubs are filled with various codes and abbreviations representing different aspects of your earnings and deductions. Here’s a breakdown of some common ones:

a. Gross Pay (GP):

Represents the total amount you earn before any deductions are made.

b. Net Pay (NP):

The amount you take home after all deductions and withholdings.

c. Federal Income Tax (FIT):

Represents the amount of federal income tax withheld from your paycheck.

d. Social Security Tax (SS):

The amount deducted for Social Security contributions, which helps fund retirement and disability benefits.

e. Medicare Tax (MED):

Represents the amount deducted for Medicare, which provides health coverage for individuals aged 65 and over.

f. State Income Tax (SIT):

Represents state-level income tax withheld based on your state’s tax laws.

g. 401(k) or Retirement (401K):

Contributions deducted from your paycheck for your retirement savings plan.

h. Health Insurance (HI):

Represents the amount deducted for health insurance premiums.

i. Overtime (OT):

Earnings from hours worked beyond your standard workweek, usually paid at a higher rate.

j. Bonus (BON):

Any additional compensation awarded on top of your regular earnings.

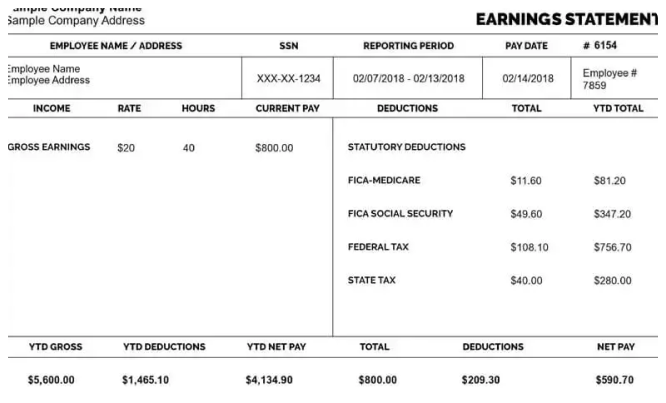

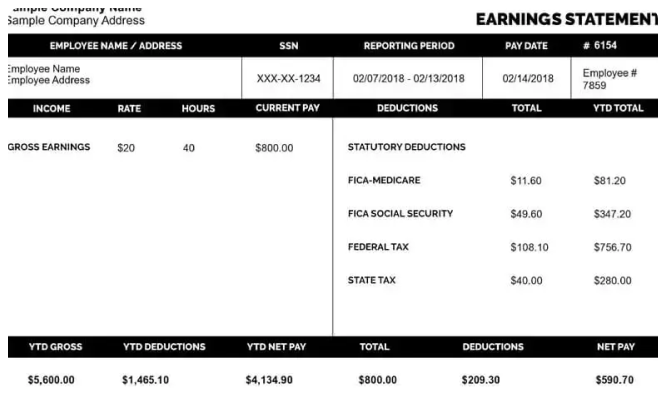

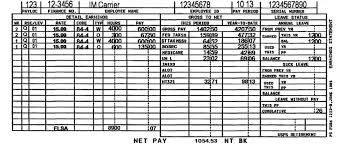

How to Interpret Your Paystub

a. Review Earnings Section:

- Gross Pay: Start by examining your gross pay, which is the total amount earned before deductions. This includes regular wages, overtime, bonuses, and other forms of compensation.

- Deductions: Look at each deduction and its corresponding code. Make sure they align with your expected withholdings for taxes, insurance, and retirement contributions.

b. Verify Tax Withholdings:

- Federal and State Taxes: Check the amounts withheld for federal and state income taxes. Ensure they match your expected tax bracket and filing status.

- Social Security and Medicare: Verify the amounts deducted for Social Security and Medicare taxes are correct and consistent with current rates.

c. Check Benefits and Retirement Contributions:

- Health Insurance: Ensure that the deductions for health insurance align with your benefits plan and coverage level.

- Retirement Contributions: Verify the contributions to your 401(k) or other retirement accounts are correct and reflect any employer match.

d. Review Net Pay:

- Net Pay Amount: Confirm that the net pay (the amount you take home) matches your expectations after all deductions are applied.

Utilizing Paystub Generators

a. Paystub Generator: A paystub generator is an online tool that allows you to create and manage paystubs. Here’s how it can help:

- Generate Accurate Paystubs: Input your earnings, deductions, and other relevant information to generate paystubs with clear and accurate codes and abbreviations.

- Customize Paystubs: Customize paystubs to include specific details and codes relevant to your situation. This ensures you have a clear and detailed record of your earnings and deductions.

b. Paystub Generator Free: A paystub generator free offers similar functionalities without cost. It can be particularly useful for:

- Educational Purposes: Use free paystub generators to create sample paystubs and understand how different codes and deductions work.

- Budgeting and Planning: Generate paystubs to simulate different income scenarios, helping you plan and budget more effectively.

Tips for Managing Paystub Information

a. Keep Records: Maintain copies of your paystubs for reference and record-keeping. This helps you track your earnings, deductions, and tax withholdings over time.

b. Ask for Clarification: If you encounter unfamiliar codes or abbreviations, don’t hesitate to ask your employer or HR department for clarification. Understanding each component ensures accurate financial management.

c. Regular Review: Regularly review your paystubs to ensure accuracy and address any discrepancies promptly. This helps avoid issues with income reporting and tax filings.

Conclusion

Understanding the various codes and abbreviations on your paystub is essential for effective financial management. By reviewing your earnings, deductions, and tax withholdings, you can ensure that your paystub accurately reflects your financial situation. Tools like paystub generator free can assist in creating and managing paystubs, helping you better understand and track your income and deductions.